This post is a summary of the interview below, where Steve Keen talks with Lachlan McCall, the President of the Young Economists Network for the ACT (Australian Capital Territory) branch of the Economic Society of Australia about the main ideas in his new book “The New Economics: A Manifesto“.

Below the video is a summary of the main points discussed in the video.

Table of Contents

Summary

This book is a follow-up to Steve Keen’s prior book “Debunking Economics: The Naked Emperor Dethroned?“.

First, by way of establishing credentials, Steve Keen has had a long and illustrious career in economics and economics research and has written a bunch of academic papers and books on a wide range of economic topics.

The book/presentation consist of the following ideas:

The money multiplier does not mirror reality

The neoclassical model of banking is called “The loanable funds’ theory” and it states that bank loans are made from consumer savings.

This is NOT how bank lending works.

Says who?

Alan Holmes, Senior VP, New York Fed 1969

“The idea of a regualar injection of reserves… suffers from a naive assumption that the banking system only expands loans after the System (or market factors) have put reserves in the banking system”

“In the real world, banks extend credit, creating deposits in the process, and look for the reserves later”.

Basil Moore, 1979

“Any increase in borrower demand for bank credit will result in an increase in both loans and deposits, providing only that banks’ lona collateral standards are met. Loans make deposits”.

Michael McLeay et al. 2014 (Bank of England)

“Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits”.

Deposits do NOT create loans, loans create deposits

In the real world, when anyone borrows money from a bank, the money they give you doesn’t come from anywhere.

They literally put money into an account for you, which you can withdraw, but was created from nowhere and put into your account.

In the real world, loans create deposits and there is a positive correlation between debt (loans) and GDP.

Credit (loans) create money which funds demand

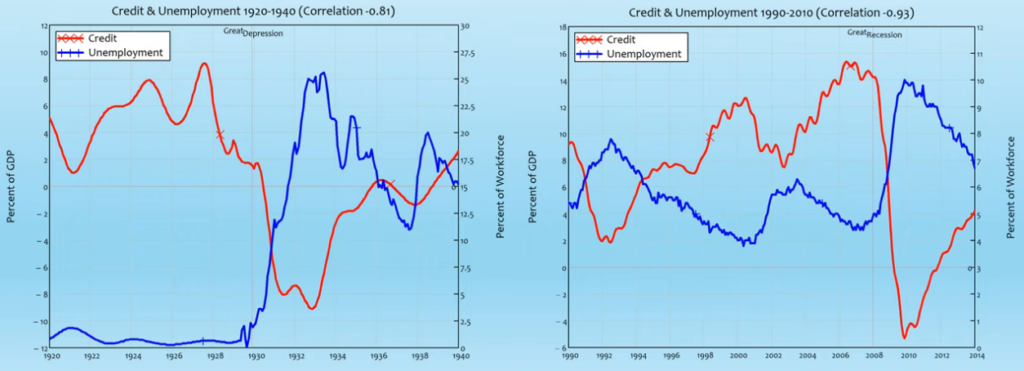

In the neoclassical loanable funds theory, consumer deposits create loanable funds that fund companies’ expansions, which lowers unemployment. Per this idea, there is no correlation between credit and unemployment.

In reality, when credit increases, demand increases, GDP increases, and unemployment decreases.

When credit decreases, demand decreases, GDP lowers, and unemployment increases.

In this model, there is a negative correlation between credit and unemployment (when credit goes up, unemployment goes down, and vice versa).

Now check this out (to enlarge the image, click on it)…

Macroeconomics is NOT effects from microeconomic causes

In the neoclassical economic ideas and models, there is an idea that macroeconomics are effects from microeconomic causes.

This is because what matters in their economic model is the behaviors of individuals, by individuals, between individuals, which when aggregated together are what we know as “the economy”.

Steve Keen then goes on to explain how it IS possible to derive macroeconomic outcomes from macroeconomic inputs, but I warn you, in this part of his presentation the math is pretty hairy and he models his claims using his Minsky software and you’re going to want to pay close attention here and probably rewind/play/rewind/play a bit.

Having said that, Steve Keen is THE GUY who predicted the 2008 global financial crisis back in 1995, using the system dynamic modeling methods he learned from Minsky, which is also the basis of his Minsky software.

His main point here is he is working straight from the structure of the economy. This model does not require the “rational agents” with a capacity for foresight that is integral to the neoclassical models.

The structure of the economy explains most of its behavior.

Economics, energy, and ecology

Steve Keen pulls up an interesting Larry Summers quote, from the IMF Economic Forum in 2013:

“I always like to think of these crises as analogous to a power failure… output would of course drop very rapidly”.

Having said that, Steve Keen claims that would be a set of economists who would sit around explaining that since electricity was only four percent of the economy, so if you lost eighty percent of the electricity you could lose no mater than three percent of the economy.

Such a statement would be both consistent with mathematical modeling of the economy, and completely absurd.

And, while anyone could see it was completely absurd, within the mathematical model, it would be correct.

Energy

Neoclassical economic modeling shows our productive output being produced by the inputs of technology, capital, and labour. However when the power fails, production stops, so clearly, energy is an essential input.

But, without energy neither capital nor labour can even happen, so energy is not a separate input per see, but rather is an essential sub-input (so to speak) of labour and capital.

Consider that the energy one human can provide is about 100 watts per hour, but the energy a machine can provide has been growing exponentially ever since James Watt perfected his steam engine.

In neoclassical modeling, when there is an 80% fall in electricity, GDP falls by 5% because you can easily substitute capital and labour for energy, no big deal.

In Steve Keen’s modeling, when there is an 80% fall in electricity, GDP falls by 38% (I warn you, his math is very advanced), because there is no substitute for energy.

Some guy name Mankiw claims even Steve is underestimating (again, based on some pretty advanced math), and in his model, when there is an 80% fall in electricity, GDP falls by 72%.

Like Larry Summers said:

“when there wasn’t any electricity there wasn’t really going to be much economy”

Less than 20% of energy currently comes from renewable sources

“Ignorance of the role of energy in production has led economists to drastically underestimate the economic impact of climate change…”

Steve Keen

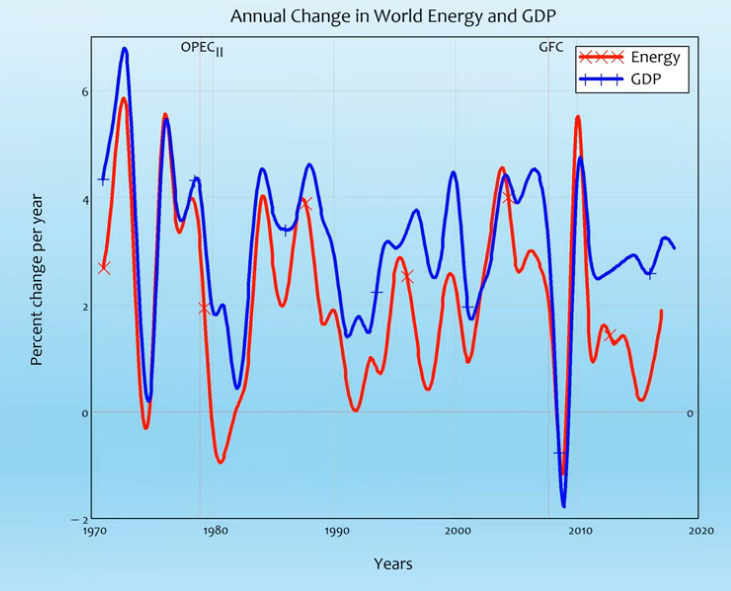

Check this out. It compares world energy use and GDP from 1970 to 2020. To enlarge the image, click it.

The economics of ecocide?

Steve Keen makes the rather hyperbolic statement that neoclassical economics is the economics of ecocide precisely because it does not include the critical nature of energy in its economic modeling.

Plus the fact that is THE dominant economic school of thought guiding policymakers around the world.

So he claims, this gross underestimation of the role of energy to our production systems is causing neoclassical economists to downplay the effects of climate change, which is clearly already starting to occur.

Per economist William Nordhaus

In 1991, economist William Nordhaus said:

“… it is difficult to find major direct impacts of the project climate chantes over the next 50 to 75 years”.

Per Steve Keen, if energy was properly included in our economic modeling, these direct impacts would be obvious.

Nordhaus further said:

“approximately 3$ of United States national output is producted in highly sensitive sectors, another 10% in moderately sensitive sectors, and about 87% in sectors that are negligibaly affected by climate change”.

This ignores that 100% of production requires energy as an input.

Per the IPPC 2014 report

Note “2014”, as in not very long ago:

“Other economic activities, such as manufacturing and services, largely take place in controlled environments and are not really exposed to climate change”.

Which leads to stuff like…

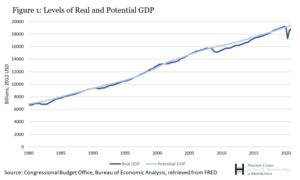

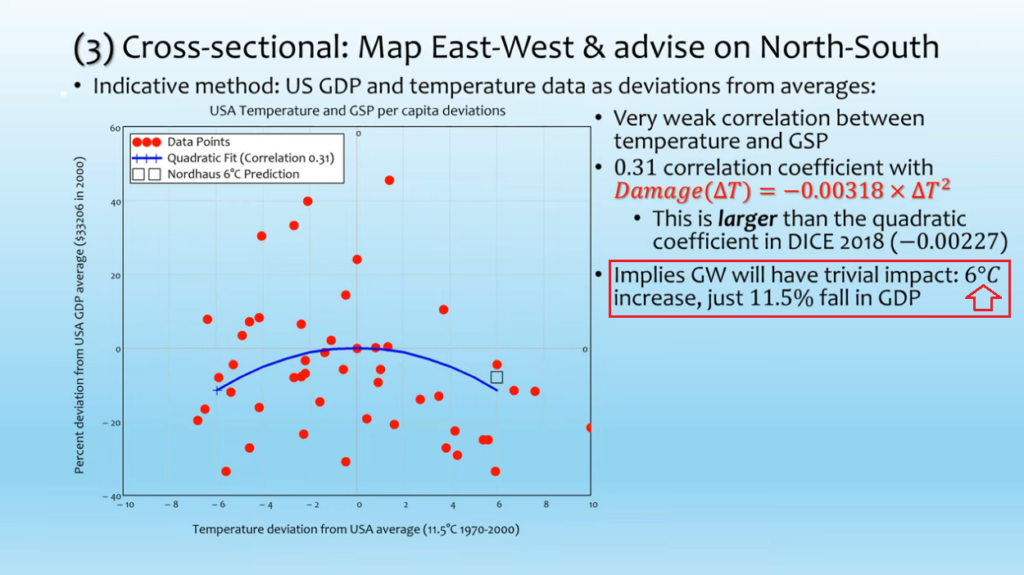

This is a model put together with data from Nordhaus. Please direct your attention to the red rectangle and the red arrow.

Apparently, an increase in the global temperate of 6 degrees Celsius (10.8 degrees Fahrenheit) will cause a drop in GDP of only 11.5%. While that is not good news, it doesn’t sound catastrophic.

But what do climate scientists and eco scientists say happens with an increase in global temperate of 6 degrees Celsius? See below, but it’s not good.

Which pits economic forecasts against ecological forecasts

While economists say a global temperature increase of 6 degrees Celsius would cause a decrease of GDP of only 11.5%, climate scientists and ecologists say a global temperature increase of 6 degrees Celsius would lead to the extinction of our species.

They claim that 2 degrees might push us beyond tipping points from which the ecosystem can’t recover (as once the increase is 2 degrees the existing feedback loops fail and there is then no stopping an increase to higher temperatures that will kill us), and we are already past 1 degree today.

This is why Steve Keen is calling neoclassical economics the economics of ecocide.

Now to be clear, the earth will survive. We just won’t be there to enjoy it

Believe it or not, his next few slides are even more depressing.

Neoclassical economists aren’t denying global warming is happening, they deny it matters

When one of your core beliefs is “capitalism can cope with anything”, global warming becomes something else it can deal with, and therefore it can’t be an existential threat.

Steve Keen is promoting that relative to the effects of global warming, economists should shut up, sit down, and listen to scientists.