When we talk about economics, we talk about the wrong stuff.

Our economic vocabulary causes us to focus heavily on things that matter very little, and not focus at all on things that matter a lot.

Table of Contents

Where does our economic vocabulary do us wrong?

The main areas are:

- Where money comes from

- The reasons banks make loans

- “Public sector” and “currency issuer”

- What the currency issuer spends on matters

- Supply chains matter more than money flows

- Unpaid and low paid care work that make “market work” possible

- Causes of inflation

Where does money come from?

Banks create money. Seriously.

In the way we commonly talk about economies, it’s easy to come to the belief that within an economy money is scarce, but if you have money there is an infinite amount of stuff you can buy with it.

The reality is exactly the opposite.

Banks can create an infinite amount of money, and what constrains an economy is the amount of stuff available to be bought.

Central banks

Every banking system in the world has a central bank which is the highest level payment clearinghouse for that banking system.

Examples are the Federal Reserve, the Bank of Canada, the Bank of England, the Bank of Japan, the Central Bank of Thailand, the Central Bank of Kenya, The Peoples Bank of China, The Central Bank of the Russian Federation, etc.

There is even the Central Bank of the Democratic People’s Republic of Korea (North Korea) and the Banco Central de Cuba.

Each central bank can be thought of as sitting at the top of a “currency zone”, which is “the economy” that uses the currency issued by that central bank.

Central banks create money when their legislative bodies pass laws that require funding.

The money creation process is generally overly complex and can be hard to follow, which I suspect is intentional, but central banks create money.

However, only about 3% of the money in circulation is created by central banks.

Commercial banks

Commercial banks create 97% of the money circulating with economies.

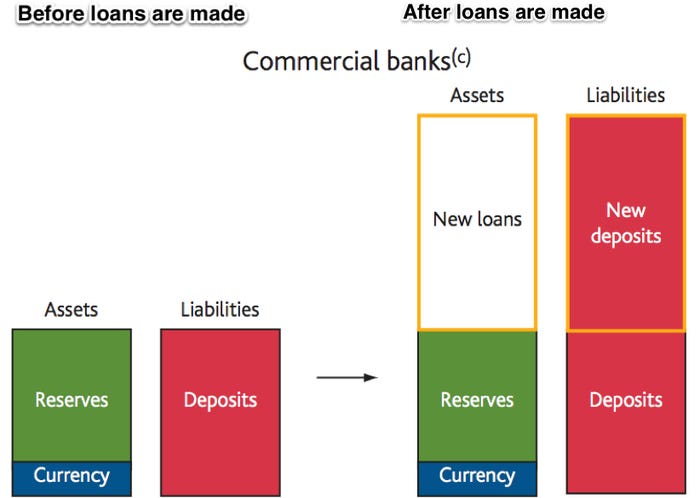

Every time a commercial bank makes a loan, they create the money being loaned out.

More specifically, they create a deposit, which they put into an account in the name of the borrower, which the borrower can then draw upon.

What matters most here is the money that appears in the deposit account did not come from anywhere.

It is not transferred from some other account and it is not taken from banking reserves.

It just appears, as if by magic, in an account the bank allows you to withdraw money from.

The image below shows how the bank’s balance sheet changes as they make loans.

The new loans and the new deposits created by them do not come from anywhere.

The image credit goes to BusinessInsider.com and their article titled: Everybody Should Read This Explanation Of Where Money Really Comes From.

The reasons banks make loans

We NEVER talk about this.

Broadly speaking there are two reasons why banks make loans (create money).

- Spend to allow businesses to create goods or services to sell.

- Spend to allow people or businesses to buy an asset.

Create more goods or services to sell

These loans increase the amount of stuff for sale in an economy.

They allow companies to form or expand.

These loans increase the overall levels of production in an economy.

These loans result in more stuff being available to buy within that economy.

For the reasons stated above, these loans are considered to be productive.

They add value to an economy.

Buy more assets

This is where the money is being loaned out so the borrower can buy something they expect will appreciate in value.

That something could be stocks, bonds, real estate, BitCoin, or coffee futures.

The problem is loaning out money for asset purchases creates asset bubbles.

And asset bubbles eventually burst, and when do they cause recessions.

How does this work?

In this example, I’ll use real estate, which IS what triggered the asset bubble burst that triggered the great financial crisis of 2008.

Someone borrows money to buy an investment property.

After some time, it’s worth more.

So they borrow more money to buy more investment property.

Others see the opportunity and they do the same.

As pricing is a function of supply and demand when bank loans fund the demand for something (in this case real estate) more people can buy it, and due to the money to be made, more people do.

So the very act of loaning out money to buy an asset causes the price of that asset class to rise.

In the 1920s people bought stocks “on margin” which is a form of debt.

In the 2000s, the focus was real estate.

However, at some point, some people in the system can’t make debt payments.

And this ripples through the entire system, as everyone has taken on debt in order to not miss out on the money-making opportunities.

The inability to make debt payments causes a “freezing up” of the availability of credit and tons and tons of people default on their loans.

The entire financial system grinds to a halt.

Businesses close down, people get laid off, etc, etc.

So WHY banks are loaning out money matters

And we never talk about this.