This is part of our series on the book “What Has Government Done to Our Money?“. This post discusses the supply of money, how free markets efficiently allocate improved standards from the fruits of capital investment, the use of two metals in coinage, and the suggestion that our banking system use a 100% reserve requirement.

Page 19

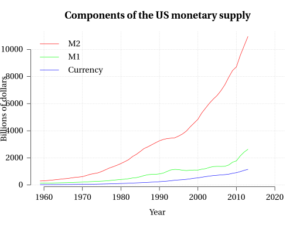

Rothbard is talking about the supply of money. In this example, he uses Gold as money. He correctly states that if the supply of gold increases, the supply of money has increased, but the supply of goods and services has not. Therefore the “cost” of goods and services decreases as the “price” of money falls due to the increased supply.

He then says “We come to the startling truth that it doesn’t matter what the money supply is. Any supply will do as well as any other supply”.

His ideas seem to put him squarely in the Austrian Economics school of thought, yet don’t Economists of the Austrian school state that we can’t “just” print more money?

Yet if it doesn’t matter what the money supply is, why can’t we just print more money? Per the logic earlier in this paragraph, it should not matter.

Page 23

Rothbard writes “Furthermore, improved standards of living come to the public from the fruits of capital investment. Increased productivity tends to lower prices (and costs) and thereby distribute the fruits of free enterprise to all the public, raising the standard of living of all consumers”.

If “free market” means free from predatory capitalism, I can see how this would be true. However, when “free market” means free from the mechanisms that hold predatory capitalism in check, that is clearly not the case.

Simply examine the US economy over the past 40 years.

Page 23 and 24

Rothbard is writing about the use of two metals as money in the same economy. He writes “It is not necessary, however, for the government to step in and save the market from its own folly in maintaining two moneys”.

Why is this “folly”? If it’s what the “free marketing” does, why is it not “freedom”?

Page 27

Rothbard seems to be promoting the value of a 100% banking reserve requirement. In doing so he seems to ignore the fact that fractional reserve banking was created in (or perhaps by) a “free market”.

It was not created through government intervention.

Per this Q&A forum (where sources are cited, a balance sheet from the London branch of the Medici Bank shows that a significant number of the bank’s debts corresponded to demand deposits. In 1477. Apparently, for the Medici Bank, it did not go well.

For the record, in the United States, uniform reserve requirements were established in 1863, when the national bank was first established.

Prior to that, regional banks, chartered by state governments, set their own reserve requirements.

Some States set no reserve requirements (which if government intervention is the opposite of freedom is maximum freedom).

If “the market” does not impose a 100% reserve requirement on banks (see above), how would this be done?

If government interference is bad, how COULD this be done?

Page 31

Rothbard writes “Inflation, being a fraudulent invasion of property, could not take place on the free market”.

However, he previously wrote, “Inflation may be defined as any increase in the economy’s supply of money not consisting of an increase in the stock of the money metal” (page 28).

We also know that fractional reserve banking (i.e.: an “increase in the economy’s supply of money not consisting of an increase in the stock of the money metal”) started in a market unencumbered by government intervention, what he refers to as a “free market”.

He seems to contradict himself.