Those neoclassical economic people love their equilibrium curves? Right?

Anyway, this post is a summary of chapter 3 of the book Contending Perspective in Economics by John T Harvey Ph.D. I’m summarizing this book because it’s such a great little book (151 pages, but packed full of insights).

So without further ado, what, and why, is neoclassical economics?

Neoclassic economics is THE dominant school of economic thought in the western world, almost to the point of having monopoly status (get it? monopoly? economics?) to the point where some neoclassical economists equate neoclassical economics with economics and know little to nothing about other schools of thought.

Table of Contents

Origins of neoclassical economics

It came into being in the mid 19th century as economics was starting to be accepted professional academic discipline.

It is a continuation of the work of the classical economists (most notably Adam Smith) and came out of the Scottish enlightenment of the 18th century.

The core concepts of neoclassical economics are:

- Marginal analysis

- General equalibrium

- Rationality

- A prior-ism

And these concepts were developed primarily by four people, who were called “the marginalists”:

- Alfred Marshall (1842-1924)

- William Stanley Jevons (1835-1882)

- Carl Menger (1840-1921)

- Leon Walrus (1834-1910)

Marginal analysis

They were trying to answer the “water diamond paradox” that Adam Smith wondered about, but never solved.

It goes like this…

It would seem obvious the value of something is a function of its usefulness.

Almost nothing is more useful than water, and almost nothing is more useless than diamonds (especially in the mid 19th century) yet very few things were as cheap as water nor as expensive as diamonds.

So obviously, the relative value or worth was not tied to usefulness.

So what is it tied to?

Marginal analysis says the perceived value of something is tied to the price you paid for the last bit of it (margin) you had of it.

And since every time you get some water, it’s cheap (or free) due to its relative abundance, that sets the value of it in your mind. The same is true of diamonds, although in their case, their relative scarcity affects your perceived value of it.

General equalibrium analysis

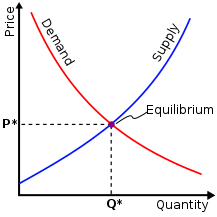

This is the idea that economic systems consist of variables that are mutually dependent, and the entire system finds “resting points” at which it stays forever unless some external force or nudge changes things (even so much as one variable) in which case a new equilibrium point is found.

This idea stems from the idea that economists are describing natural laws rather than social behavior, and that what was true for someone living in Rome in the year 87 AD is also true of someone living in Paris in 1492 and is also true of someone living in London in 1860.

These natural laws just are, and it is the work of economists is to figure them out and document them.

The rational agent

Neoclassical economists assume all agents (people, businesses, etc) within an economic system act as rational agents.

That we make the best rational decision we can, armed with all the information we need, to provide for ourselves while looking to improve our individual interests.

This focus on the individual agent being the “center of attention” is central to neoclassical economics.

From their perspective, macroeconomics is an offshoot of microeconomics, since all the little transitions we each do seeking to improve our lots in life IS what creates the macro effects within the economy.

A priori-ism

A priori-ism is the use of structured rational arguments derived from self-evident propositions.

For example:

- Premise 1: All Texans love guns.

- Premise 2: Jim is a Texan.

- Conclusion: Jim loves guns.

Now, there are two important parts of this logical argument stuff

First: Is the argument logically consistent? Do the premises lead to the conclusion.

And second: Are the premises reasonable? Do we believe them to be true?

This matters because nothing prevents a logically consistent argument from being built on unreasonable or even worse obviously flawed premises.

And neoclassical economists have interesting ideas about what makes a premise reasonable and most likely to be true.

They believe that intuitive evidence (evidence obtained from thought experiments) is more valid than empirical evidence (evidence obtained from observation).

This has led to some bad jokes over the decades, such as, if an economist wanted to understand something specific about horses, rather than go out and watch horses, they would sit alone in a room and think “Now what would I do if I was a horse”.

Their emphasis on intuitive evidence has resulted in criticism from economists of other schools sometimes claiming that sometimes the neoclassic economists continue to use premises after they’ve been demonstrated to be wrong.

Additionally, another aspect and criticism of neoclassical economics is the “as-if” method, where if a model produces accurate predictions, it’s not a problem for it to contain aspects that are known to be wrong. That the predictability of the model is most important.

A more scientific example of this last idea is that while we know Newton’s theory of gravity is incomplete and our understanding of gravity was updated with Einstein’s Theory of General Relativity, we still use Newton’s equations to send spacecraft around the solar system and keep communications satellites where they need to be.

How did neoclassical economics become so dominant?

This occurred after the second world war.

Marginal analysis provided to be a very useful tool in solving the allocation and maximation problems of scarce resources under the conditions of full employment which were created by the war effort.

Unfortunately, lessons from the great depression were lost somewhere.

During the great depression, the big problem was the desperate need to find employment for an overabundance of idle labour.

That neoclassical models and tools did not explain the greatest crisis capitalism ever faced were somehow no longer relevant as the world pushed to full employment and scarce resources and the neoclassical models performed superbly under those conditions.

Additionally, as the world war ended and the cold war wound up, any economic theories that did not conclude capitalism was best were of no interest to American institutions, which now dominated how the world should think about things.

Partly to avoid being labeled with political labels, economic research became less focused on policy and became more abstract, mathematical, and theoretical.

The full employment assumption

One basic or foundational idea that got cemented into neoclassical economics is the idea that economies reach equilibrium at full employment and there are no obstacles to this occurring. Maybe not today, or this week, but that is where the economy will take itself if left alone.

This seems to be a result of the idea that macro effects occur because of micro causes.

Methods

Some of this has already been said, but to summarize, neoclassical economists believe that:

- The logical point of economic analysis is the individual.

- In modeling the behavior of individuals, it’s important to define/create premisis that are intuitively true and self evident.

- Phenomonon are placed within an equilabrium framework.

- Analysis focuses on the marginal unit of consumption

Views of human nature and justice

Humans are viewed as individuals operating according to natural laws. While religion, community relationships, language vary from culture to culture, economic behavior is considered to be universal.

Criticisms

Other schools of economic thought criticize the “as-if” and ask how intuitive evidence (thought experiments) can be more unbiased than empirical data obtained through observation. Especially when “as-if” premises have no requirement to model anything in the real world.

Neoclassicals claim they do compare their models to the real world at the level of predictions.

Critics respond that this is something neoclassical economists say, but that neoclassical research almost never does this.