First, I wish to state that the structural theory of inflation is the one that I personally understand the least. Likely as a result of having had the privilege of living my entire life in countries with well-developed economies (Canada and the United States) and as such, not personally seeing evidence of this in my day to day life

The structural theory of inflation states that while market power is a source of inflation, a larger cause of inflation, in some economies, are societal and cultural issues affecting a countries politics or economics which affect how the economy can be structured.

If you found this blog post via search, it probably makes sense to start at the first post in this series (the link is above), as it contains information and ideas that are mentioned here.

Table of Contents

Factors influencing structural inflation

Markup theory

Markup theory states that the effects of demand-pull and cost-push can not be separated. They always travel together.

Intuitively this makes sense. For example:

Demands for higher wages increase the cost of a widespread production input (that being wages) which creates cost-push inflation.

If the demand for oil goes up, OPEC sometimes reduces production in order to raise profits per barrel, as that improves their overall profitability, which creates cost-push inflation as oil is part of producing everything we consume.

I’m not sure this works the other way around. I’m not now able to think of an example where the cost increase of a production input would then create higher demand, and hence trigger demand-pull inflation.

Bottle-Neck inflation

The idea here is that when wages rise and the prices of products increase at the same time, this shows up as inflation.

And, as prices do not increase evenly across every sector of the economy, but rather some sectors experience inflation faster than others, there are “bottleneck” industries.

In the US over the past 40 years, I guess we can say that the bottleneck industries are healthcare, housing, and higher education.

For what it’s worth, I don’t understand how this argument is really different from markup theory. They seem very similar to me.

Is this a developing economy phenomenon?

It seems to be.

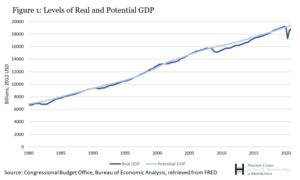

The idea, as expressed here, is that increasing investments and expanding the money supply are not the ultimate factors causing inflation in developing countries.

You need to dig deeper.

In some economies, increasing investment in agricultural production, and expanding the money supply which increases aggregate demand, has not resulted in increased levels of domestic food production.

Why?

Per this theory, because some nations and economies have structural impediments.

These show up in various ways.

- Policies (laws) about land ownership, and land use.

- Use of older less productive agricultural practices.

- Resource gaps in private sector (for example, inadequate supply of fertilizer).

- Policies encouraging funding company formations and expansion through private sector debt, rather than equity.

- Currency exchange rates.

- Lack of adequate power (production stops when the power fails).

- Lack of adequate roads and railways.

Can “external” investment solve this problem?

I’m really getting out of my comfort zone here, but I’m thinking probably not.

For the following reasons:

Loans from the IMF and the World Bank come with strings attached, and those strings seem specifically defined to allow multinational corporations ownership access to resources and firms.

It would seem this creates an incentive structure that completely disregards the needs of the local population.

Additionally, if the problems are indeed structural, no amount of “financial engineering” CAN solve them.

If there are truly societal impediments to creating effective markets, they can only be solved within that society.

There is no way “external rules” that do not take the existing societal and cultural norms into account can help.