Table of Contents

What is the market power theory of inflation?

The market power theory of inflation simply states that if a firm, or a collection of firms working together, have enough dominance within a market, they set prices for the market.

These firms are often referred to as “price makers” for what should be obvious reasons, and market power is sometimes referred to as pricing power.

If you found this blog post via search, it probably makes sense to start at the first post in this series (the link is above), as it contains information and ideas that are mentioned here.

How are “price fixing” and inflation related?

Inflation vs “price fixing”

Inflation is when prices rise in such a way as to affect the general cost of living for a society. When the purchasing power of people within that society diminishes over time.

That being the case, which prices are being fixed matters.

When a few firms corner the market on avocados, that does not result in widespread price increases across the economy.

When a few firms corner the market on oil, it does.

Which sectors of our economy affect many others?

This applies to what we call commodities, which are widely consumed and often widely used in the production of other goods.

We drink A LOT of coffee. We raise most of our meat animals on corn. Without silicon, there are no computer chips.

But the most obvious one is oil.

When the cost of oil goes up, the cost of everything goes up.

Is the price of oil determined by a cartel?

That would be OPEC, the Organization of the Petroleum Exporting Countries. Which consists of the 13 most oil-rich nations on Earth.

What evidence supports the market power theory of inflation?

Oil

One of the challenges of cartels setting prices is all the members must agree.

If OPEC decreases production levels overall, the supply of oil drops, and the per-unit price of oil rises.

Every OPEC nation benefits from this, but if one OPEC nation cheats, they stand to benefit even more.

If all 13 OPEC nations agree to a 20% cut in production, their per barrel profit goes up and they’ll make more profit on fewer barrels.

But if one of them resumes full production, that nation makes even more.

If they then all resume full production, the entire exercise was for nothing.

And this essential mistrust helps keep OPEC production levels up, and oil prices down.

But… After the 1973 Arab-Israeli war, in which the USA supported Israel against Egypt, the larger OPEC members, who are Arab nations, all said “Where do I sign?” and they convinced the other member nations to go along.

The result was a global gas shortage, a US recession, and the “stagflation” of the 1970s.

Drugs

The Consumer Price Index (CPI) which is measured and reported by the US Bureau of Labour Statistics, contains some pharmaceuticals.

Medical care (in general) makes up 8.004% of the total CPI “basket of goods” and prescription drugs make up 1.141%.

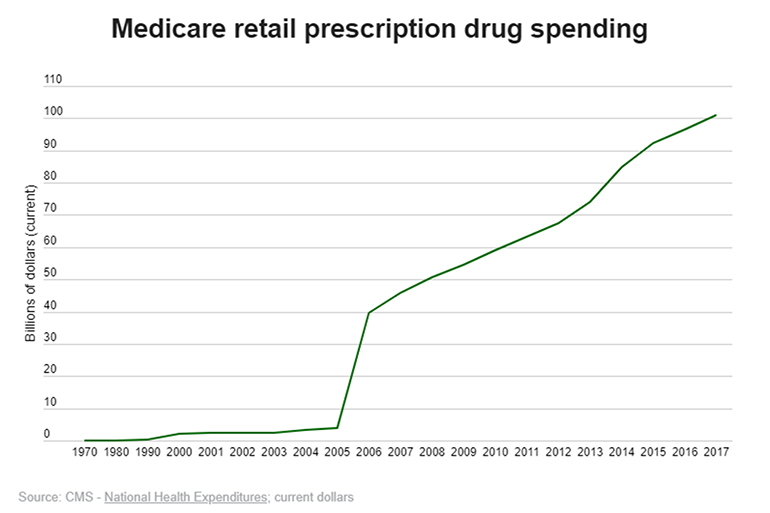

So, when prescription drug prices rise, it causes inflation. And they have risen.

And this increase in drug prices, being part of the CPI, contributes to inflation.

Housing

Interestingly, rent is included in the CPI basket of goods, but not mortgage payments. For houses that are owned, the CPI impact is what the home could be rented for if the owners were to rent it, not what they pay for their mortgage, insurance, etc.

For this reason, the way the BLS counts housing costs as part of CPI is often criticized, and I think appropriately so.

I could not find anywhere what percentage of the CPI is rent payments, but we do know for sure it’s more than zero.

And we know that rents have been increasing rather alarmingly in most urban centers in the USA and Canada.

So while I was not able to find the specific numbers as I wanted, and rent is not a commodity in the true sense, we know that when rent payments increase throughout the economy, CPI increases.

So what would happen if Wall St investors were to start buying up single-family homes across America, treat them like any other investment asset class, and jack up rents?

Which, for a variety of reasons, is happening.

Now, having said all that, this last example of evidence is not evidence of past inflation, as these corporate investors buying up single-family homes across America is fairly new.

So maybe it’s a warning of what’s to come.