The Cowboy Economist, John T Harvey, PhD, explains how the private sector finances its deficits.

Table of Contents

Summary (as in, not a word for word transcript)

Opening question

The opening question is “When will we stop borrowing money from China”?

But first, how does the private sector finance deficits?

Let’s start with banks

Most people think banks loan out other peoples savings.

In fact, commercial banks that make consumer loans create money out of thin air.

While paper bills and notes are money, most money is electronic entries in bank computer systems.

How do those electronic entries get made?

Actually, lets start without banks

In the old west, farmer Pat might come into the general store, need seed corn, but not have money.

Since the shop keeper has known the farmer all his life and knows him to be good for it, he’ll give him seed corn in exchange for an IOU.

Then when the corn crop is sold, the farmer will return and buy the IOU back from the shop keeper.

That IOU is as good as money.

Let’s say the IOU is worth $50, and the store keeper wants to buy a saddle from the saddle maker that costs $50.

He can transfer the IOU to the saddle maker in exchange for that saddle.

The saddle maker can then also transfer the IOU to the whiskey distiller in exchange for $50 worth of whiskey.

That IOU can travel all around town before farmer Pat has had a chance to harvest and sell his corn.

If there are a few hundred farmers in the community, there might be a few hundred of such IOUs circulating around town.

It’s entirely possible the IOUs circulating amongst the townsfolks are in fact of greater value than all the “actual” money.

And that means

The IOUs perform functions just like money.

That will be true even if farmer Pat defaults, although in that case his particular IOU becomes worthless.

The entire system depends on trust.

The shop keeper has to trust that farmer Pat will harvest and sell his crop.

The saddle maker has to trust that the shop keeper is a good judge of value.

Or in “econospeak”

“A financial system is a series of interconnected promises to pay someone else in the future, and it is stable and viable only so long as these different entities trust one another”

John T Harvey, Cowboy Economist

Now, lets add banks

Today, we don’t require shop keepers, and saddle makers, and whiskey distillers, to judge the credit worthiness of farmers or anyone else, nor do they directly issue IOUs as the shop keeper did for farmer Pat.

Today, we have a banking industry that does that on behalf of everyone.

Today, 97% of all the money in circulation was created by commercial banks in the process of extending credit.

97% of the money in circulation exists because someone took out a loan, and this created brand new money.

A little accounting illustrates how this work

Like all businesses, banks have assets and liabilities.

Assets add to the value of the bank, liabilities are what they owe somebody else.

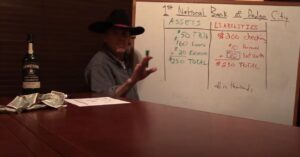

The assets of this made up bank is:

- $50,000 in treasury bills (promises by the US government to pay someone in the future)

- $160,000 in loans they’ve made to people

- $20,000 of reserves sitting in the vault

- For total assets of $230,000

The liabilities of this made up bank is:

- $200,000 in the checking accounts of depositors

- $10,000 in money they borrowed

- Since this adds to $210,000 and the bank has assets of $230,000, this bank has a net worth of $20,000

That $20,000 of net worth, is the most important number in this example.

If the assets of the bank drop by $20,000 or more, the net worth of the bank is wiped out and the bank becomes insolvent.

How is money created by the bank when someone takes out a loan?

For this example, let’s pretend you borrow $30,000 to buy a new car.

On the asset side of their ledger, the amount of loans they’ve made increases from $160,000 to $190,000.

Their total assets are now $260,000.

They then hand me a checkbook, to an account that has $30,000 in it.

On the liability side of their ledger, the amount in the checking accounts of their depositors changes from $200,000 to $230,000.

Their total liabilities are now also $260,000.

The loan is made, and in the process, $30,000 of new money was created out of thin air and it appeared in the checking account they opened for me.

What happens when I give the $30,000 to the car dealership?

If the car dealership banks at the same bank, the bank simply transfers the money from one checking account to another.

If the car dealership banks somewhere else, and the “loss” of your $30,000 deposit would make them insolvent, this bank can borrow money from other banks. Recall that one of the liability line items of the bank is money they’ve borrowed.

If the bank is unable to borrow money from any other bank, their worst case scenario is they have to sell $30,000 worth of treasury bills.

But the Federal Reserve makes all this a non issue

But, no bank is free to do whatever they want here. There are federal banking regulations determining how much money banks must keep in reserves.

The federal regulations is the bank must keep 10% of their checking accounts liability in their value.

That’s why in the initial balance sheet numbers, for $200,00 of checking account liabilities, the bank kept $20,000 of reserves in their vault.

Rewinding this example back to the initial numbers above:

Assets:

- $50,000 in treasury bills (promises by the US government to pay someone in the future)

- $160,000 in loans they’ve made to people

- $20,000 of reserves sitting in the vault

- For total assets of $230,000

Liabilities

- $200,000 in the checking accounts of depositors

- $10,000 in money they borrowed

- Since this adds to $210,000 and the bank has assets of $230,000, this bank has a net worth of $20,000

You can see that the reserve balance becomes an issue the moment the bank makes the loan and puts the newly created money into your checking account.

At that moment, their checking accounts liability increases from $200,000 to $230,000, which means the reserves in their vault need to be $23,000, not $20,000.

First, banks have a 14 day grace period in which to add to the reserves in their vault.

However, what are their options?

- $3,000 can be borrowed from other banks. This is a very common way banks get funds to cover their reserves. This is what The Federal Funds Market is all about. That’s where banks that wind up with excess reserves make overnight loans to banks that need more.

- If there is no money available via the Federal Funds Market because every bank is short of reserves, the competition for reserves will drive up the price of money, the interest rate.

- The primary function of the Federal Reserve is to maintain a target interest rate.

- And if there is a risk that competition for reserves will drive up the interest rate, the Federal Reserve injects more reserves into the banking system.

- If they were to do this for this bank, they would buy $3,000 worth of treasury bills and provide $3,000 worth of cash. This would cause the Treasury Bills asset to reduce to $47,000 and the Reserves asset to increase to $23,000.

Because the Federal Reserve maintains an interest rate target, they are somewhat OBLIGATED to do this.

When there is competition for reserves that would drive up interest rates, they either inject more reserves into the banking system, or they don’t hit their interest rate target.

As a consequence of what is described above, in the real world the Federal Reserve doesn’t have much control of the supply of money in the economy, despite what you may have learned elsewhere.

The Federal Reserve only has a very indirect control over the supply of money.

To maintain their interest rate target, they can provide or drain reserves from the banking system, but banks today are not constrained by reserves.

The bottom line here is every time a commercial bank makes a loan, they create brand new money.

This is because credit (loans) ARE money.

In fact, 97% of money was created this way.

Banks are creating the money that people use to make purchases, buy consumer goods, built restaurants, plant crops, etc.

This money that is created then activates real resources that then create more goods and services for us.

And guess what?

The federal government does the same thing.

Just like this process in the private sector where when the private sector wants to deficit spent it can create money, within certain constraints of course, the federal government can do the same thing.

We are NOT borrowing money from China.

What IS going on there will be explained in a later video.

What the federal government is doing is creating it’s own financing to activate idle resources, just like the private sector does.