Ravel Software Tutorial: Page 17

Transcript (and yes, this IS for SEO purposes) Transcribed by TurboScribe.ai. Hi, this is Kevin, and I’m a student in Steve Keen’s Revel Economist Challenge,

Transcript (and yes, this IS for SEO purposes) Transcribed by TurboScribe.ai. Hi, this is Kevin, and I’m a student in Steve Keen’s Revel Economist Challenge,

If you’re learning to create dynamic models using the Minsky and Ravel software, you will find these two tutorials to be of value. Modeling with

Here is a video of a hearing of the Congressional Subcommittee on Digital Assets, Financial Technology and Inclusion, help on 14 Sep 2023, on the

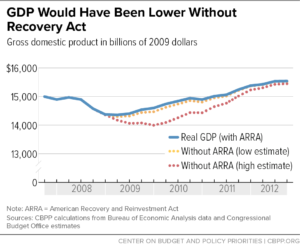

The long boom was not without its bust cycles, but during this 20 year period of general economic expansion, they were fairly short and fairly

While most people think of neoliberalism as having started in the late 1970s or early 1980s, its roots go back to the end of world

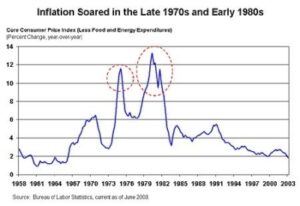

The great inflation of the 1970s actually started around 1965 as the chart below shows. And believe it or not, the consensus on what caused

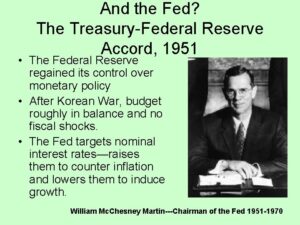

The Fed-Treasury Accord of 1951 was a bank regulation that created what we refer to as the independence of the Fed. We say this because

When World War 2 came to an end, the Federal Reserve had a dual mandate to 1) keep the interest rates on government securities low

I know new world order has become a loaded phrase these days with ideas of the great reset, etc, but I don’t have a better

The bank regulations that changed in the United States to help pay for world war two almost exclusively affected operations of the Federal Reserve, which

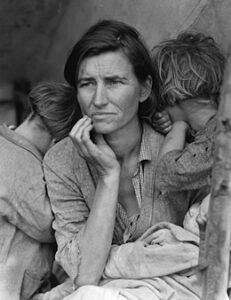

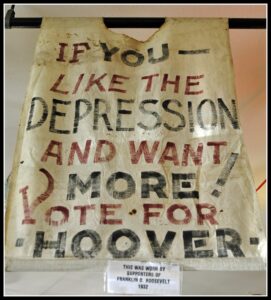

How big was the problem? The economic impact of the great depression is illustrated by the two charts below. The first shows the US GDP

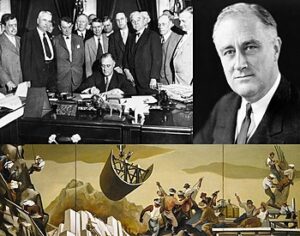

In what ways did bank regulation lead to the great depression? In what ways did bank regulation change as a result OF the great depression?

In a very real sense, the roaring twenties was started by world war I, which started an economic boom for the United States. European nations

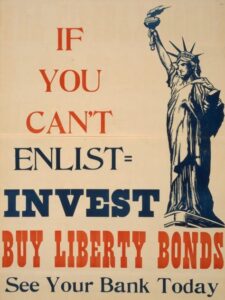

Financing world war one started simply, as people expected the war to be quick. As months dragged on, things got more complex. The United States

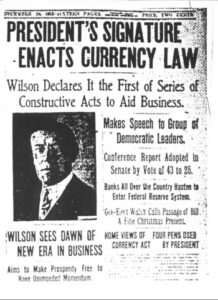

After the US government created a national currency in 1863, the US dollar (also known as the greenback) the banking system of the United States

Much has been written about the Federal Reserve, and much will be in the future. Was it an innovation to stabilize the financial system? A

Bank regulation and the creation of greenbacks… The US free banking era started in 1837 when the second Bank of the United States dissolved after

Prior to the dissolution of the second Bank of the United States (due to Congress not renewing its charter in 1836), bank regulation for state

Early in the history of the United States, bank regulations were created for the existence of a national central bank. This was actually tried twice,

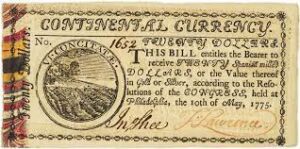

How did bank regulation allow the United States to fund the rest of the War of Independence? Robert Morris was appointed Superintendent of Finance of

When the American colonies were British, each colony issued their own currency, denominated in the British currency units: pounds, shillings, and pence. The values of

Bank regulation in the United States was never designed from a big picture perspective. Rather, a problem was identified and solved. This generally created more

Yet these economic ideas are still used as the basis for public policy. This blog post identifies some and clarifies how we know they’re false.

Yet these economic ideas are still used as the basis for public policy. This blog post identifies some and clarifies how we know they’re false.

This blog follows my interests in learning about money, banking, economics, supply chains, etc. This interest started a few years ago when I was made

This post is part of a series where I examine (which really means “read up on”) the economic and political development of the Scandinavian (or

This post is part of a series where I examine (which really means “read up on”) the economic and political development of the Scandinavian (or

This post is part of a series where I examine (which really means “read up on”) the economic and political development of the Scandinavian (or

This post is part of a series where I examine (which really means “read up on”) the economic and political development of the Scandinavian (or

This post is part of a series where I examine (which really means “read up on”) the economic and political development of the Scandinavian (or

I’ve seen many contradictory comments online about “Scandinavian socialism” vs “No, they’re capitalist”. Some feel Scandinavian economies fit modern definitions of socialism, others feel they’re

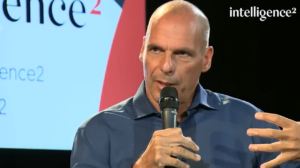

This post is part of a series about a discussion (framed as a debate) between Gillian Tett and Yanis Yaroufakis on the subject of saving

This post is part of a series about a discussion (framed as a debate) between Gillian Tett and Yanis Yaroufakis on the subject of saving

This post is part of a series about a discussion (framed as a debate) between Gillian Tett and Yanis Yaroufakis on the subject of saving

This post is part of a series about a discussion (framed as a debate) between Gillian Tett and Yanis Yaroufakis on the subject of saving

This post is part of a series about a discussion (framed as a debate) between Gillian Tett and Yanis Yaroufakis on the subject of saving

This post is part of a series about a discussion (framed as a debate) between Yanis Yaroufakis and Gillian Tett on the subject of saving

This post is part of a series about a discussion (framed as a debate) between Yanis Yaroufakis and Gillian Tett on the subject of saving

There is no denying capitalism has brought the world incredible material wealth and prosperity, especially since the end of world war 2. Having said that,

Let me open by saying that it is very recently that I’ve learned anything about Marxist economic theory, but what little I’ve learned so far

Dr. Stephanie Kelton is a professor of economics and public policy at Stony Brook University. She is the author of the bestseller The Deficit Myth

Dr. Steven Hail is an economics lecturer at the University of Adelaide in Australia. This blog post is a summary of two videos (a part

In the traditional capitalist idea of the absentee investor who receives financial benefits as a right of ownership without doing any work, the answer is

Nomi Prins was a Wall St banker, who after 9/11 reassessed her life choices and became somewhat of a traitor to her tribe and an

While my next sentence might seem petty, I do feel it’s appropriate for me to reveal that for some reason I can’t quite identify, I

This post is a summary of a YouTube video where L Randall Wray is discussing (explaining may be more accurate) that from the perspective of

This blog post is a summary (of sorts) of a podcast episode: Macro and Cheese Episode 42 – Repo Mania: Has The Fed Bailed Out

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This post is part of a series of posts that summarizes the book Angrynomics by Eric Lonergan and Mark Blyth. If you found this post

This series of blog posts is a summary of what I consider to be the excellent book Angrynomics, by Eric Lonergan and Mark Blyth. I

I keep bumping into this idea online. Here are four articles making this claim What specific claims do they make? We know what we know

How did the arrival of gigantic mega-ships break our global supply chains? This topic is covered in depth in the Odd Lots podcast episode: How

If you found this post via search, it probably makes sense to start with the first post in this series on the cost of shipping.

If you found this post via search, it probably makes sense to start with the first post in this series on the cost of shipping.

If you found this post via search, it probably makes sense to start with the first post in this series on the cost of shipping.

If you found this post via search, it probably makes sense to start with the first post in this series on the cost of shipping.

This blog post is a quick-to-read summary of the Odd Lots podcast episode: Why the Cost of Shipping Goods From China Is Suddenly Soaring. Bear

A little background information on this US treasury auctions explainer video This is a goofy little video published to YouTube six years ago that does

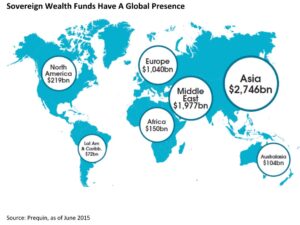

Canadian sovereign wealth funds As a country, Canada does not have any sovereign wealth funds. Alberta But the province of Alberta does. The Alberta Heritage

We’ll start with the biggest ones. The Government Pension Fund of Norway Total assets and year founded The Government Pension Fund of Norway is actually

We’ve all heard the best way to build long-term wealth is to buy and hold stocks. Can governments do this for the benefit of their

In this series of posts, we’ve taken a look at seven nations whose growth in economic value is considered to be somewhat miraculous. The seven

If you found this post via search, it probably makes sense to start with the first post in this series. The link to the full

If you found this post via search, it probably makes sense to start with the first post in this series. The link to the full

If you found this post via search, it probably makes sense to start with the first post in this series. The link to the full

If you found this post via search, it probably makes sense to start with the first post in this series. The link to the full

If you found this post via search, it probably makes sense to start with the first post in this series. The link to the full

If you found this post via search, it probably makes sense to start with the first post in this series. The link to the full

If you found this post via search, it probably makes sense to start with the first post in this series. The link to the full

A simple question, with answers from across the spectrum While there are many articles and studies on this topic, there seems to be quite a

What is the World Trade Organization? I often find useful definitions on the website Investopedia. Created in 1995, the World Trade Organization (WTO) is an

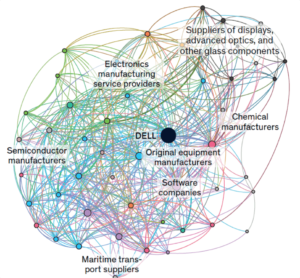

Since any chain is only as strong as its weakest link, and modern manufacturing supply chains are incredibly intertwined, it seems safe to say we

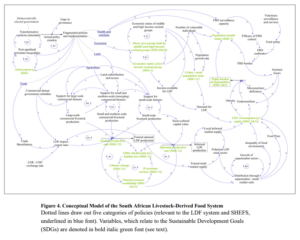

To give you an idea of the complexity of modern supply chains, and the evolution of supply chains over time, the image at the top

Warning, this blog post is a bit of a rant. Consider yourself warned. And why is the economics of supply chain management generally ignored by

The rational expectations theory of inflation is part of the neoclassical focus of modern economics (the word “rational” probably gave it away), which was first

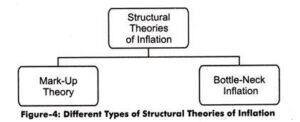

First, I wish to state that the structural theory of inflation is the one that I personally understand the least. Likely as a result of

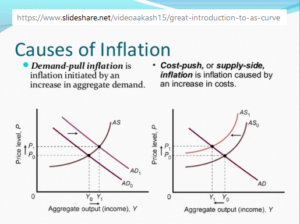

While demand-pull and cost-push inflation theories are different, they seem, to me, to be two different sides of the same coin. They are both based

What is the market power theory of inflation? The market power theory of inflation simply states that if a firm, or a collection of firms

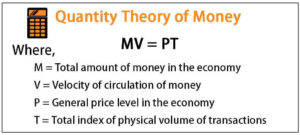

I admit the title of this post is hyperbolic, as the quantity theory of money is not flat out wrong, but it is, at best,

To examine what causes inflation, we must first define what inflation is, and believe it or not, there is some disagreement here. Definitions of inflation

If you found this post via search, it probably makes sense to start with the first post in this series. The prior posts in this

If you found this post via search, it probably makes sense to start with the first post in this series. The prior posts in this

If you found this post via search, it probably makes sense to start with the first post in this series. The prior posts in this

If you found this post via search, it probably makes sense to start with the first post in this series. It contains ideas that will

When we talk about economics, we talk about the wrong stuff. Our economic vocabulary causes us to focus heavily on things that matter very little,

Reverse logistics is a phrase a first stumbled across about a week ago. When I googled for what it means, I was left with the

Republican Congressman Ken Buck (now retired) believed in enforcing antitrust laws, to the point of creating new ones when the existing ones do not address

If this concept is new to you, the first question is what is a federal reserve repo? Federal reserve repo means Fed “repurchase agreement” A