The long boom was not without its bust cycles, but during this 20 year period of general economic expansion, they were fairly short and fairly shallow.

————————————

This post is part of a larger series and sub-series.

Here is a link to the series: The history of banks and banking regulation

and to the sub-series: United States Banking and Bank Regulation History

————————————

Yes, there was a recession in the early 1980s which is considered to be a direct result of the Federal Reserve increasing interest rates to dampen the stagflation of the 1970s.

Yes, there was a savings and loan crisis where numerous savings and loans failed in the mid to late 1980s and early 1990s.

Yes, there was a dot com stock bubble that burst in the late 1990s.

But notwithstanding those financial shocks, the overall trend during this twenty-year period was one of greater prosperity for the American economy overall.

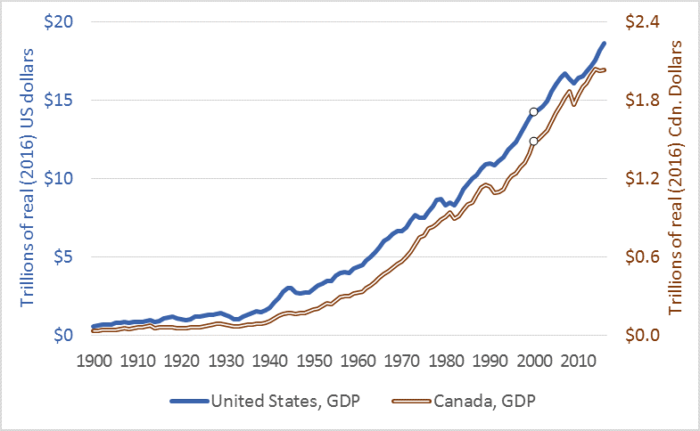

In July of 1991, US GDP peaked after 92 months of expansion, and in March of 2001 US GDP peaked again after 120 months of expansion.

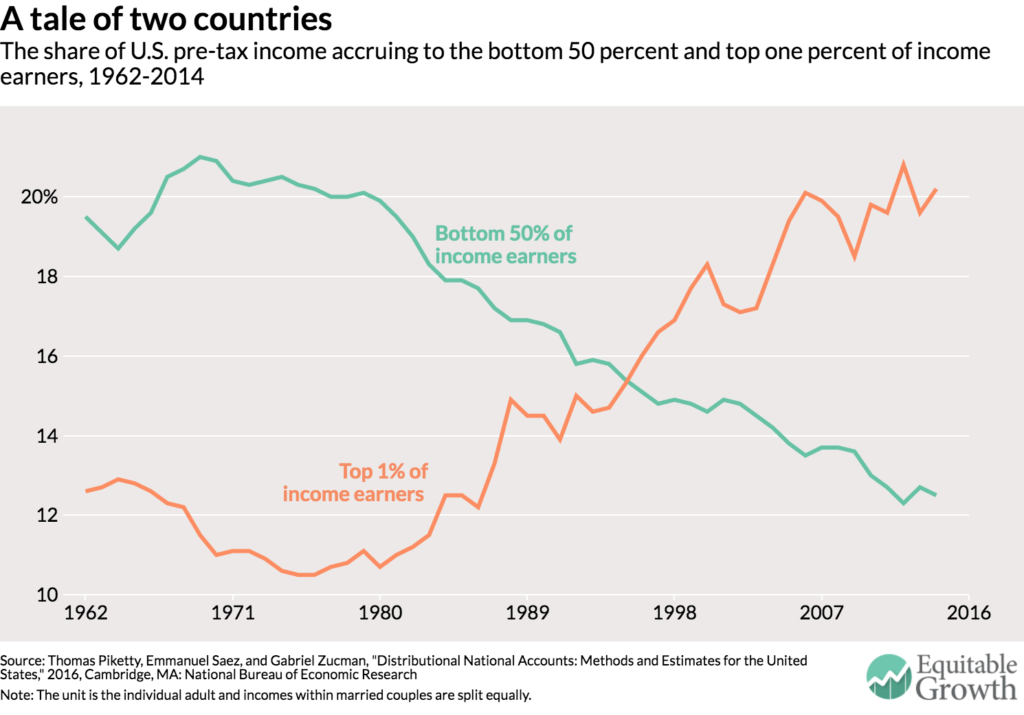

However, this economic rising tide did not lift all boats, as you can see from the graph below.

1980 was around the time that the share of US pre-tax income started to sharply rise for the top 1% of income earners, while the share of US pre-tax income for the bottom 50% of income earners started to sharply fall.

Why did this happen? In short, neoliberal policies combined with major advances in IT, computer networking, and maritime shipping.

But the GDP expansion during this period was very significant, as you can see from the graph below.

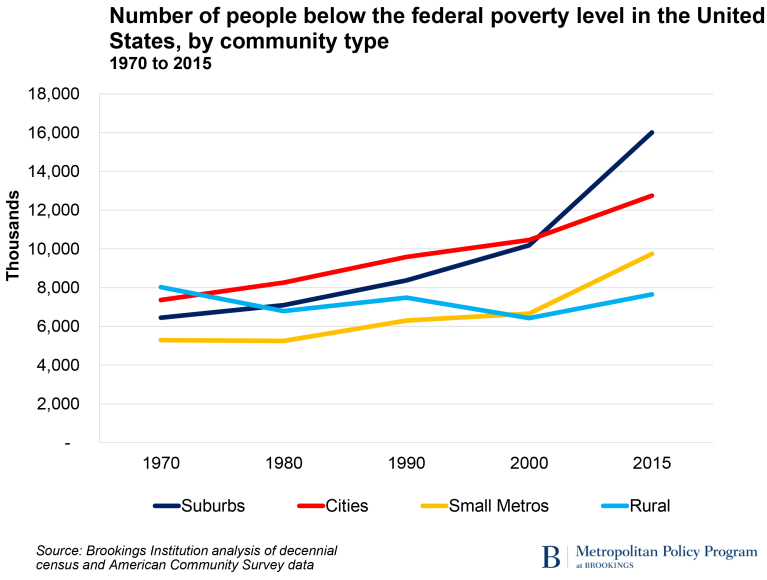

And this happened simultaneously while the number of people living in poverty also grew.

So how did this happen? What split the US economy in two, and created the environment where the rich got richer and more people became poor?

Table of Contents

Offshore outsourcing of manufacturing

The innovations in IT, computer networking, and maritime shipping mentioned earlier allowed manufacturing to be moved to lower-wage countries, thereby shuttering manufacturing facilities in the US. While this trend started in the 1970s, it accelerated greatly in the 1980s and has continued to this day.

Finance becomes explicitly productive within GDP

Believe it or not, there was a time when profits made from finance were not included in our measurement of GDP. This is because financial services are not inherently “productive”, which is to say they do not directly result in the increased production of goods and services.

This idea that finance does not add to production is not new. Adam Smith wrote of this in his seminal work The Wealth of Nations, where he stated that capital and wages add value to the nation while rents (unearned income) subtract value by diverting money away from productive uses.

Now, some finance does fund the creation and expansion of making things, but by excluding finance from GDP, we avoid counting the finance that doesn’t.

So, if you want your GDP to be growing in an economy that over time produces less and less manufactured products, how do you do this?

You add profits from finance into the measurement, which occurred in 1993.

The legalization of stock buy backs

A stock buyback is when a publicly traded company uses some of their profits to buy back their own stock on a public stock exchange.

Once upon a time, it was illegal stock price manipulation.

Why? Because the price of anything is a function of supply and demand. A corporation buying back it’s own stock increases demand, which will tend to increase the price of the stock, without any of the companies financial fundamentals changing.

Back then, it seems the prevailing thought was that a higher stock price needed to be earned, by producing innovative products and or grabbing greater market share.

This changed in 1982 when the Securities and Exchange Commission passed rule 10b-18, which created the legal process for these buybacks.

Today, stock buybacks are a standard mechanism for a company to “manage” its share price, which can be hugely beneficial to shareholders, which generally includes senior executives who are granted stock options as part of their compensation package.

The long boom included the transition to a rentier economy

In short, the 1980s was when the economy started to shift from benefitting people who made things to benefitting people who owned things.

The best phrase I’ve seen to describe this is that we now have a rentier economy, in which the winners are the ones who are paid for owning things since making things has become a much smaller part of our economy.