In what ways did bank regulation lead to the great depression? In what ways did bank regulation change as a result OF the great depression?

Many financial crises are caused by debts that can’t be paid, at an enormous scale, which causes the inability to meet payment obligations to ripple through a financial system, which in turn causes a wave of insolvencies and bankruptcies.

Then, in the aftermath, banks and other institutions who make loans pretty much stop, partly because they don’t have the capital to allow them to do so, and partly because they got so badly burned just a little while ago by having done so.

————————————

This post is part of a larger series:

The history of banks and banking regulation

and sub-series:

United States Banking and Bank Regulation History

————————————

Table of Contents

The run up to the great depression

The trigger for the great depression was loans that could not be paid as a result of people trading stock on margin, which means the broker loaned the investor/speculator money to buy the stock, and after the stock value fell, they didn’t have the money to “top up” their margin accounts which by law investors are required to do.

So, how did it happen that so many people bought stocks with borrowed money?

In short, not only was it “within the rules”, but the rules allowed investors/speculators to borrow up to 90% of the value of the stock.

Now, strictly speaking, this isn’t the result of bank regulation, as stock brokerage firms were not banks, and as such were not regulated like banks.

But, brokerage firms DID make loans, which was generally considered to be a banking activity and the regulations on the brokerage industry allowed the 10% margin accounts.

If margin accounts had not been allowed at all, the buying of stock with borrowed money would not have occurred. If margin requirements were 50% rather than 10%, the extent of the debts that could not be paid would not have been nearly as large.

This is how regulation led to the great depression.

During the depression

Banking regulation in the USA includes the monetary policy of the Federal Reserve, which is the bank that sits at the top of the US banking system.

Part of their charter is they set and target a specific interest rate, and to do this they manage the amount of bank reserves in the US banking system. These two activities are related and what matters most in this terse summary is the amount of money in the US banking system is not static but is constantly changing, driven by the monetary policy activities of the Federal Reserve.

One set of policies injects more money into the economy (and increases what we call the national debt), another set takes money out (and decreases the national debt).

Because people did not (and in many cases still do not) understand that the currency issuer within an economy (or more accurately “currency zone”) is not a household and can not behave like a household, there was this idea that restoring prosperity to the United States required paying down the national debt.

But not realizing that there is a relationship between the national debt and the amount of money in circulation in the economy, when the government took action to pay down the debt, they shrank the US money supply.

This reduced money supply reduced demand for goods and services (as there was literally less money to buy stuff with) and this had the effect of deepening the depression.

Bear in mind, this perceived need to reduce the national debt was based partly on the failure to understand that the US government is the source of all US dollars, and on the belief that economies always reach equilibrium at full employment.

The Banking Act of 1933 (Glass-Steagall)

The Banking Act of 1933, commonly known as Glass-Steagall created a wall of separation between investment banking and commercial banking. This created FDIC-insured deposits and prohibited banks from speculating with FDIC-insured deposits.

The idea that deficit spending adds money to the economy

The UK, and much of the world, was also experiencing the depression when a British economist named John Maynard Keyes (whom Keynesian and post-Keynesian economics are now named after) saw that the economy was NOT reaching equilibrium at full employment, so he thought about what it would mean if that belief was in fact not true.

This led to him publishing his General Theory of Employment, Interest and Money, in 1936.

He is the person who first pushed the idea of “helicopter money”, or in plain terms, for currency-issuing governments to spend money into the economy by hiring people to do stuff, and turning currency-issuing governments into the employer of last resort, in a similar manner to which currency-issuing government were already acting as lenders of last resort, through their central banks.

Mobilzing for war: Previously unprecidented economic stimulus

As it looked like Europe might be heading towards war, President Roosevelt signed The Neutrality Act into law in 1935, which prohibited the US from exporting arms and ammunition. A new neutrality act in 1937 made it illegal for Americans to travel on ships owned by any belligerent nation and made it illegal for any American-owned ships to carry arms destined for a war zone.

Even after the German army invaded Poland on September 1st, 1939, the USA remained neutral.

Then, on December 7, 1941, Japan attacked Pearl Harbor. The US declared war on Japan the next day and declared war on Germany on December 11th.

This provided the USA with the moral justification for deficit spending to embark on the largest economic stimulus program the world had ever seen.

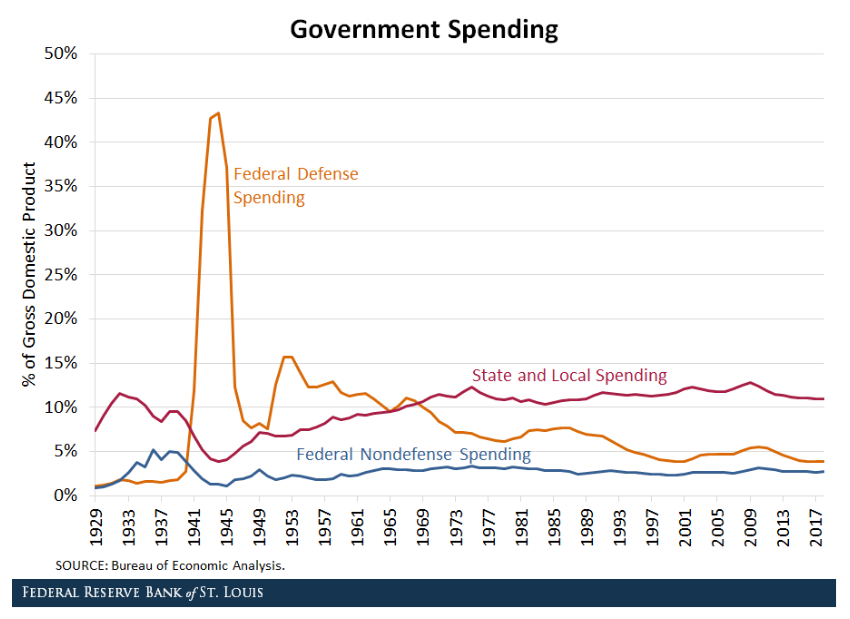

The mobilization for war involved the US federal government spending well over 35% of total US GDP for the next 4 years.

This level of deficit spending, and the massive amount of manufacturing done for the war effort, pushed the US economy to full employment, perhaps for the only time it has ever occurred.

This level of deficit spending was enabled by the US government going off the gold standard in March of 1933, shortly after President Roosevelt was inaugurated for his first term. Most other nations had abandoned the gold standard late in 1932, so this was not an odd thing for the US to do.

Going off the gold standard enabled the US to create the amount of money necessary to buy everything needed for the war effort.

And this massive deficit spending, the justification of which was mobilizing for war after the bombing of Pearl Harbor, provided the economic stimulus that brought a close to the great depression.