Much has been written about the Federal Reserve, and much will be in the future. Was it an innovation to stabilize the financial system? A way for bankers to “skim off the top” every time the US government adds more money into the economy? Both? Maybe even more?

I know that I too will write much more about the Fed as I continue this series of posts, but for now, I wish to talk about why a central bank was deemed appropriate, and how it came to be born.

————————————

This post is part of a larger series and sub-series.

Here is a link to the series: The history of banks and banking regulation

and to the sub-series: United States Banking and Bank Regulation History

————————————

As stated earlier in this series of posts, bank regulation in the United States was never thought out in advance. It grew like a fungus, one problem, one solution, one new problem, one new solution, etc, at a time.

So, what problem occurred that made the creation of a central bank seem like an appropriate solution?

In a nutshell: bank panics.

Payment processing and clearing between banks was done by private banks, some of which were for-profit, some of which were non-profit, and they acted as lenders of last resort within limited geographies. Because they were “just” privately owned banks, there were limits to how much money they could inject into the economy when the demand for cash was high, as happened when people thought their bank might fail and their money might disappear as a result.

What we call a bank run, is a bunch of people rushing to the bank and saying “give me my money”. When this happens at a large scale, demand for money can exceed the supply of available money, and when that happens banking systems and economies collapse.

There were bank panics in 1873, 1884, 1890, and 1893.

Additionally, the federal government figured out it was a really big fish in the pond of our banking system and that their banking activities rippled through the system, because of the volume of dollars involved. This allowed the government to inject money into the economy by buying bonds, and by 1887 this practice was well established.

In 1899, the Secretary of the Treasury started using national but privately owned banks to stabilize money markets.

However, then as now, some people looking to make money in finance saw bank regulations as restrictive so they formed trust companies that provided banking-like services without actually being banks and therefore were not subject to commercial banking regulations.

When the Knickerbocker Trust Company (the third-largest trust company in New York with more than $60 million in deposits) failed in October of 1907, one of the largest bank panics in US history started.

The US government quickly realized they didn’t have enough cash to deal with the crisis.

And a single individual, a banker named John Pierpont Morgan emerged as the saviour of the nation’s financial system when he personally provided tens of millions of dollars in the form of loans and deposits to several New York banks and trusts.

The suddenness and extent of the economic collapse left the country stunned and shaken.

Congress created a commission (the Monetary Commission) to study what caused the panic of 1907 and to recommend measures to prevent something similar from occurring in the future. This commission was chaired by Senator Nelson W Aldrich.

The investigation lasted four years in total.

The main conclusion is the panic was caused by speculative investment bubbles caused by a loose monetary policy. Large sums of money were borrowed to buy assets, and when there was a fall in asset values such they could not be sold to allow the loans payments to be met, the inability to meet loan payment obligations quickly rippled through the financial system.

The recommended solution was to set up a central bank, which would be the ultimate clearinghouse for payments AND the ultimate lender of last resort.

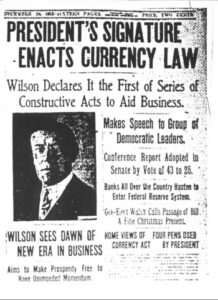

This central bank was set up via the Federal Reserve Act of 1913.