Prior to the dissolution of the second Bank of the United States (due to Congress not renewing its charter in 1836), bank regulation for state banks was lax, and afterwards, it stayed so, for quite a while.

Between 1829 and 1837 the number of state banks in the United States more than doubled.

————————————

This post is part of a larger series and sub-series.

Here is a link to the series: The history of banks and banking regulation

and to the sub-series: United States Banking and Bank Regulation History

————————————

New York removed the requirement for a special charter before a new bank could be incorporated.

Several other states followed this policy of “free banking”.

In 1829, New York did set up a bank supervisory authority, and a more formal banking commission was created after the panic of 1837, which created reserve requirements.

The first deposit insurance was passed by the state of New York in 1829, but for some reason, it did not work.

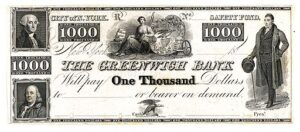

From 1836 until the civil war, the currency used in the United States was the banknotes issued by state banks

By the time of the civil war, there were 8,000 kinds of money in the United States. Due to so many different banks issuing so many bills which all looked different, counterfeiting was both easier than today and much more prevalent.

The values of the banknotes fluctuated from bank to bank, and from time to time, depending on their perceived quality. Since not every $1 bill was considered to be worth $1, shops kept lists of the banknotes they would accept, and at what valuation. If you entered a store with banknotes they didn’t accept, you couldn’t buy anything.

When the US Civil War started both sides needed to buy stuff. The Union issued bonds, but as the war dragged on, they realized the bonds didn’t raise enough money, and after talking with New York bankers, they realized they couldn’t raise sufficient funds with bonds.

It was suggested the American government issue paper money an idea that met with resistance. Some feared it would create a financial calamity, similar to the experience with Continent Currency during the War of Independence.

But they needed to buy stuff for the war effort, so in 1862, they started issuing paper money, not backed by gold, called greenbacks.

In February of 1862, the Legal Tender Act was signed into law by President Lincoln, which authorized the issuing of $150 million of this currency. A second Legal Tender Act was signed into law in 1863 which authorized the issuing of $300 million more.

Green ink was chosen because it was thought to fade more slowly and to be harder to counterfeit.

The Confederate states also printed paper money, but it was so easy to counterfeit that the south became flooded with counterfeit bills. A Philadelphia printer (Samuel Upham) created a large amount of them to sell as novelties, and they were so good that people in the north bought them to use to buy southern cotton (yes, even during the US Civil War, mills in the north bought cotton from the south that was knowingly produced by slave labour).

Much to the surprise of some, many Americans were glad to see a nationally issued currency, as the only money they had ever used before then was not accepted everywhere and the values of it fluctuated. And now, for the first time in their lives, every dollar was accepted everywhere and had the same value.

After the war, some fiscal conservatives wanted the greenbacks retired. Some demanded the US government make good on their promise to convert them to gold.

And believe it or not, a political party formed, The Greenback Party, based on the idea that this fiat currency provided increased financial stability and should become THE currency.

In January of 1879, the US government began converting greenbacks into gold, but very few people showed up to redeem them. Americans had become accustomed to this currency and considered it to be as good as gold.