The Cowboy Economist, John T Harvey, PhD, explains how the (currency issuing) government finances its deficits. I added currency issuing, as in the USA, only the US government issues US dollars. All other levels of government are currency users, just like you and I.

Table of Contents

Summary (as in, not a word for word transcript)

The National Debt

Many Americans are concerned about the size of our national debt.

The national debt is now larger than the US economy.

A summary of the prior video (how the private sector finances deficits)

Commercial banks create money via keystrokes in computer systems every time they loan someone money.

The purpose of the prior video, explaining how the private sector creates money out of thin air, is to prepare people (you) to hear how the currency issuing US government does the same thing to finance themselves.

The US government ALSO creates money out of thin air

While people tend to view creating money out of thin air as an unnatural act, both the private sector and the currency issuing government sector do this, and they do so in similar ways.

There are four important things we need to understand about public sector money creation.

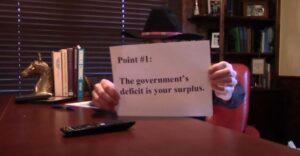

#1: The US government deficit is the private sector surplus

The US government deficit is the amount the US government spends minus taxes received.

The US government debt is the total of all accumulated deficits, minus any surpluses that have occurred.

Because every deficit has an offsetting surplus, when the US government goes into deficit, who is in surplus?

The answer is: you and me (actually all the currency users, which includes you and me).

The if US government is spending more than they receive in taxes, WE, the currency users, are receiving that money. They are injecting that money into the economy.

#2: The US government prints the money to finance the deficits

They don’t really print money any more. It’s done via computer keyboards and entering numbers into computer system ledgers, but it operates the same.

This is the same as when the private sector commercial banks create money to finance their deficits.

The process is different, but the result is the same.

The process is:

When the Treasury Department knows they’re going to need extra cash, they sell treasury bills to primary dealers of treasury bills.

This drains cash from the private sector because when they sell them, the treasury bills go out into the private sector, and the cash used to buy them goes to the treasury.

Recall that the Federal Reserve has an interest rate target.

When the sale of treasury securities removes cash from the private sector, this has the effect of nudging interest rates up.

In order to prevent this from happening so they hit their interest rate target, they’re going to buy up those treasury bills.

For all practical purposes, all that happens here is the Federal Reserve gives money to the Treasury Department.

But, they did so through a third party, which is the primary dealers of treasury securities.

So, the Treasury Department sells treasury securities to the primary dealers and in exchange take money out of the economy

Then the Federal Reserve buys those treasury securities from the primary dealers and puts that money back into the economy.

At the end of this process, the Treasury Department has money that didn’t exist prior to this stuff occuring.

Fun fact: The largest holder of US treasury securities is the Federal Reserve, for this very reason.

Recall from the last video that when the commercial banking system is low on reserves because they’re created more money than there are banking reserves to support, the Fed is forced to inject those reserves to maintain their interest rate target.

The same thing occurs when the Treasury Department pulls money out of the economy through the sale of treasury bills.

#3: The US government can not be forced to default on US debt

This is because the US debt is denominated in US dollars, the currency they create out of thin air.

While this should be the least controversial idea here, it tends to be the hardest for people to believe.

Below are a bunch of quotes from people in authority talking about this very idea.

And yes, this is an “appeal to authority”, but we’re talking about US law, which is based on authority, so here are some appeals to authority.

“As the sole manufacturer of dollars, whose debt is denominated in dollars, the US government can never become insolvent”.

Federal Reserve Bank of St. Louis

“The necessity of a government to tax in order to maintain it’s independence and it’s solvency is true for state and local governments, but it is not true for the national government”.

Beardsley Ruml, Chairman of the Federal Reserve Bank of New York, 1941-1946

“Central banks can issue currency effectively without limit”.

Alan Greenspan, Chairman of the Federal Reserve, 1987-2006

“Reagan proved that deficits don’t matter”.

Dick Cheney, Vice President of the United States, 2001-2009

The US government can NOT be forced to default.

When someone says they can be forced to default, they’re either wrong, or lying.

#4: Printing money and US deficits do not cause inflation

Sometimes people accept the first three ideas above, then think that this money creation process causes inflation.

This is a case of a myth refusing to die in the face of mountains of contradictory evidence.

Consider this…

After the 2008 financial crisis, the US government spent in deficit in ways not done since WW2.

Those deficits were by far the biggest deficits since the war.

We did not experience inflation as a result. In fact, exactly the opposite occurred.

The rate of inflation from 2008 to 2019 (when this video was made) has been the lowest rate of inflation of any decade since the 1950s.

This is true despite the fact that those deficits were the largest by far since WW2.

So what’s going on?

Why didn’t this record deficits financed through the creation of new US dollars cause inflation?

To answer this question, let’s think about WHY the US government and or the private sector deficit spends in the first place.

It’s because someone (either the US government or the person taking out a bank loan) want to be able to purchase resources to use for their purposes.

For example, if you’re a farmer you might borrow money to buy seed to plant corn.

The money is borrowed in order to get control of some resource. In this example, seed corn.

If you’re an entrepreneur, you might want to build a restaurant.

This means you need bricks, mortar, fry cooking machines, fry cooks, and so on, so you can open your restaurant.

The US government might want to build a bridge or a school or something like that.

So the whole purpose of deficit spending is to get command of a resource and use it/them for the purposes you think are best.

Now… what happens if there are currently no unused resources? If there are no idle resources out there?

We’ll use labour as it’s easiest to think about.

What if we are at full employment, and you or the US government decides to deficit spend in order to hire more workers.

The US government is deficit spending in order to hire more park rangers, and the restaurant owner is deficit spending in order to hire more fry cooks.

If you’ve got more competition for the labour than there is labour, then the cost of labour is going to go up, which causes inflation.

If resources are in short supply, then deficit spending, by the private or public sector, can be inflationary.

After the 2008 financial crisis, there were 15 million people unemployed in the US.

So resources were not in scarce supply.

And so it is no wonder that we had the biggest deficits since WW2 with no inflation.

Because we were activating idle resources.

Now let’s contrast that to an earlier period, WW2.

US unemployment was under 2%, yet deficit spending was even bigger than after the 2008 financial crisis.

It was terribly inflationary during WW2, as there were no idle resources to active.

And THIS is why there was rationing, and wage and price controls;

There weren’t enough tires, there weren’t enough cars, there weren’t enough radios.

So people were competing for these scarce resources.

And why weren’t there?

Because the US government was using those resourced.

They were taking command of them, building tanks and so forth, so stuff was in short supply.

So absolutely, deficit spending, by the private or public sector, can cause inflation, but it depends on other circumstances.

People who saying that money growth causes inflation are living proof that a little knowledge is a dangerous thing.

This entire notion that money growth causes inflation is a perfect example of that.

Here is a link to an article I wrote for Forbes magazine explaining how money growth does not cause inflation.

Why do we want the US government to spend in deficit at all?

For the private sector, labour is a cost to be minimzed.

As a result, there is no reason to expect the private sector to hire everyone who is willing to work.

If they do, great. But if they don’t, it’s because their businesses don’t need, or can’t afford, extra workers.

The private sector is not wrong to minimize the use of labour.

However, this has terrible social consequences if we do not try to address this (unemployment) in another manner.

So, for example, we could have the US government hire people instead, as they did during WW2.

In 1941, US unemployment had dropped to 9.9% (from a high of 25%), and the Japanese did far more to reduce that lingering US unemployment than Ford, Sears Roebuck, Coca Cola, or any other companies.

What the Japanese did was to justify, philosophically, the US federal spending they desperately needed to do.

Otherwise, they were thinking of deficit spending just as we do today.

They saw it as being unnecessary and a burden and were indeed trying to cut back on deficit spending.

In fact, during the great depression unemployment rose to 25%, and in 1936 or 1937 we reduced it to 14%.

And the next thing the US government tried to do was to balance the US budget, which resulted in unemployment climbing up to 19%.