Table of Contents

Says who?

What absolute idiots would ever say something so stupid?

Alan Greenspan, former Chairman of the Federal Reserve

“There is nothing to prevent the government from creating as much money as it wants”.

Granted, this quote does not directly address paying down, or even paying interest on the national debt, but in it the then Chairman of the Federal Reserve makes the unequitable statement that the US government simply creates money whenever “it wants”.

Frank Newman, former Deputy Secretary of the US Treasury

“The United States has never paid off all of it’s Treasury Bonds, not once, ever. And it never has to be”.

In this clip, a former Deputy Secretary of the US Treasury says straight out there is no need for the US to every pay down the national debt.

Ben Bernanke, former Chairman of the Federal Reserve

“We need to do that [print money] because our economy is very weak and inflation is very low”. When the economy begins to recover, that’ll be the time to unwind those programs, raise interest rates, reduce the money supply, and make sure that we have a recovery that does not involve inflation”.

Like the Alan Greenspan quote above, this one also does not directly address paying down the debt, but in it this former Chairman of the Federal Reserve says in plain language that the US not only “prints money”, but needs to.

John Yarmuth, Chair of the House Budget Committee

“The federal government is not like any other user of currency. Not like any household, any business, any state or local government. We issue our own currency and we can spend enough to meet the needs of the American people, the only constraint being that we do need to worry about inflation from that spending”.

This clip of John Yarmuth is slightly more than 26 minutes long, but during the interview part (he takes call later) he CLEARLY and correctly identifies how the US federal government is not like a household, issues a sovereign currency (although he doesn’t use that phrase) and the US economy is constrained by the availability of real resources, not by the ability of Congress to vote to create more money.

What are these people talking about?

A very important thing about the US economy, and the economies of most nations on earth today, is nations which issue a sovereign currency, like the US dollar, the UK pound, the Japanese Yen, the Chinese yuan, the Russian ruble, the Indian rupee, the Thai baht, etc. are the issuers of their currency.

They literally create currency from nothing according the whatever the rules of their nation and economy are.

In the US, whenever Congress passes a bill that requires funding, this sends instructions to the Treasury/Fed (which from an operational perspective are two different sides of the same coin – get it? coin? get it?) to create the money needed by the provisions of the bill.

To take this idea one step further…

When we say “national debt”, what exactly are we talking about? How was it borrowed from?

I know everyone says the US is in debt up to their eyeballs to China, but in reality:

- That money was never borrowed from anyone.

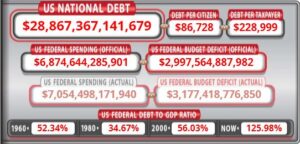

- China holds $1.1T in US treasury bonds, out of a total of $28.8T, which is 3.8%.

It was never borrowed from anyone? What?

Most people, even some economists, Treasury Secretaries, and public policy people, seem to not understand the distinction between the currency ISSUER and us currency USERS.

This distinction REALLY matters.

Check this out…

Every time someone spends a dollar, someone else receives a dollar of income.

Every time someone has a dollar (in any form), it can only be because they previously received that dollar as income.

Right now, in aggregate, we users of US dollars have $28.8T stashed in various accounts, mattresses, whatever.

That means there MUST be $28.8T of expenses which funded, or created, this aggregate surplus.

Want to take a wild guess what it is? Where all these US dollars came from?

But treasury securities ARE the national debt, right?

We call it that, but they’re deposits. That earns interest.

When you have money in a commercial bank checking account that pays no interest and use some of that money to buy a Certificate of Deposit (CD) that pays interest, are you making a loan to the bank?

No, it’s a deposit.

When a bank that has accounts at the Federal Reserve does the same thing, it works the same way.

Federal Reserve reserve accounts are like checking accounts and pay no interest. Federal Reserve treasury accounts are like CDs that do.

So Chinese banks, who have accounts at the Federal Reserve moved US dollars from reserve accounts into treasury accounts.

And why wouldn’t they? The reserve accounts pay no interest and the treasury accounts pay some.

And where did they get the US dollars they have on deposit at the fed?

From us, and that that “Made in China” stuff we bought using US dollars.