Warning, this blog post is a bit of a rant. Consider yourself warned.

And why is the economics of supply chain management generally ignored by economic models?

Table of Contents

First, some definitions

What is economics?

Investopedia has a good definition, which starts with:

Economics is a social science concerned with the production, distribution, and consumption of goods and services. It studies how individuals, businesses, governments, and nations make choices about how to allocate resources.

What is supply chain management?

Again, Investopedia has a good definition, which starts with:

Supply chain management is the management of the flow of goods and services and includes all processes that transform raw materials into final products.

Per these definitions

Economics encompasses supply chain management.

Yet…

Yet when I read about economics, while they may make reference to “production” and “distribution”, when I see well-defined economic models and/or descriptions of such models, they all talk almost exclusively about money, and very very very little about stuff.

It’s as if an underlying assumption is that money matters more than goods and services.

I get that money matters.

In fact, financial services enable the ability to activate resources within an economy.

But… people commonly talk about economics as if the currency issuer within an economy has a scarce supply of money (“how will they pay for it?”), yet if they can find enough money, it seems there is no end to what can be bought.

In reality, exactly the opposite is true.

In any given economy (or more accurately, currency zone, as economies and deeply intertwined these days) the currency issuer can, if they so desire, print money forever.

They don’t want to, and that’s a good thing, but they could.

But… no matter how much money they print, there is a finite amount of stuff that can be bought.

That is because not only do economies produce a finite amount of goods and services, but there is a level of productivity where an economy maxes out.

Investments fall into two broad categories

- Productive investments result in the production of more goods and services. Money spent this way is used to start firms and/or expand existing firms.

- Speculative investments result in the buying of assets, with the hope the value of the assets appreciate over time.

Productive investments have supply chain implications, speculative investments don’t.

How much of which occurs?

Per Oren Cass of American Compass, an organization that defines its mission as:

To restore an economic consensus that emphasizes the importance of family, community, and industry to the nation’s liberty and prosperity.

About 2% of total investments within the United States are productive, which means 98% are speculative.

This is stated in their article: We’re Just Speculating Here…

Speculative investments and financialization

Their website contains this article as well: Has the Financial Sector Become a Drag on the Real Economy?

And to summarize, “investments” in assets do not add real value to our economy.

They do not add to our output of goods and services which IS the true wealth of the nation.

They merely swap cash for some asset.

When shares are bought in some firm, the firm doesn’t get the money, the prior shareholder does.

Nothing changes for the firm (corporate stock buybacks of course distort this, but not in a good way).

Is our “extreme financialization” why supply chains are excluded?

When the bulk of “investment” in an economy is the buying of speculative assets, is the importance of supply chains minimized?

Did we use to include the management of supply chains in some way, then at some point we stopped? I could not find any indication that this is true.

But our GDP measurement doesn’t include speculative investments? Right?

I’ve also read that our measurement of GDP does not include speculative investments, but only investments that produce tangible goods and services.

This would indicate that the extreme financialization of our economy is not reflected in our measurement of GDP.

I’m interested in learning more about this

Clearly, this is an area where my understanding is incomplete.

I’m curious to learn more but have so far found very few papers that even talk about supply chains in economic terms.

Supply Chain Perspectives seems to be a somewhat generic look at the history and evolution of supply chains and their contribution to our increased standard of living. It is published on the WTO (World Trade Organization) website.

Supply chains and equitable growth seems to be about precisely what the title states.

Supply Chains and the Human Condition is a reprint of a paper previously published in a Marxist journal, which I expect is where a paper with such a title would be published.

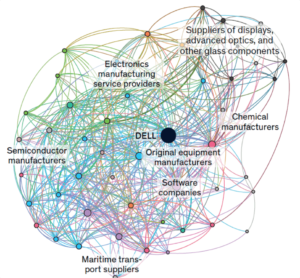

A Network Economic Model for Supply Chain versus Supply Chain Competition seems to be about just that. How firms used to run highly vertical supply chains while competing with each other, but these days supply chains are networks of firms who compete with other networks of firms and their supply chains.

And while I plan to read them (when time permits), I’m curious for analysis of such papers done by others.

If you have insights, you can contact me via the Contact Us form on this website.