While demand-pull and cost-push inflation theories are different, they seem, to me, to be two different sides of the same coin.

They are both based on the basic concept that prices are a function of supply and demand.

I can’t state these ideas fully explain inflation, but they’re so obviously true, even in limited applications, that any general theory of inflation has to take them into account somehow.

If you found this blog post via search, it probably makes sense to start at the first post in this series (the link is above), as it contains information and ideas that are mentioned here.

Table of Contents

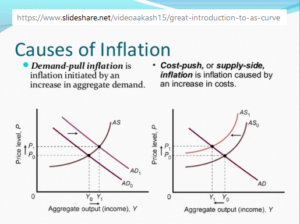

Demand-pull inflation

Demand-pull inflation is when demand outgrows supply, which is not able to keep up, and does so on stuff whose prices have a wide effect across the economy.

Examples would be oil, corn and soy (which in the US are primarily food for meat animals), silicon, etc.

A good case study in demand-pull inflation is the price increases being experienced now, during the pandemic.

Used cars

As people were advised to isolate, demand for used cars went up, stocks of used cars went down (as people bought them) and prices of used cars rose.

Lumber

Demand for lumber rose, and prices of lumber rose. Having said that, lumber prices have since come back down.

Computer chips

There is a global computer chip shortage which is leading to shortages of manufactured items.

New cars

Such as new cars, each of which needs computer chips.

Rental cars

Rental car companies needed money, so they sold their fleets because car rentals were way down anyway, and now that people are starting to travel again, there is a massive shortage of cars to rent, car rental companies are slow to replace their fleets because of the new car shortage caused by the computer chip shortage, and car rental rates rose.

Shipping capacity

As demand for consumer items rose, demand for shipping capacity from Asia to the US rose, and the cost of shipping a container from China to the USA rose from $4,000 a year ago to $20,000 now.

Cost-push inflation

Cost-push inflation is when supply costs rise, often due to shortages, but for other reasons too.

When the cost of production inputs rises, the cost of the finished goods rises.

Shortages

So, what causes shortages on a large enough scale to cause inflation?

Production cuts

When OPEC cuts production, the supply of oil goes down, and the cost of oil goes up.

Natural disasters

A few years ago a hurricane destroyed Puerto Rico and the world ran short of intravenous bags.

Why? Because it turns out almost all the intravenous bags in the world were made in Puerto Rico.

Government policies

The hyperinflation in Zimbabwe was triggered by large-scale crop failures, which were preceded by government policies that transferred the ownership of farmland to people who didn’t know how to farm.

Wages

Rising wages also contribute to cost-push inflation as wages is an input to every good and service produced.

Monopolies

This also ties into what is called market-power inflation.

It is when one firm, or a very small set of firms, has such a strong lock on a market segment that they set the prices higher.

And if you have a problem with their higher pricing, tough! Learn to do without.

Exchange rates

Changes in exchange rates can change the cost of imported parts and sub-assemblies, as well as the cost of finished goods when those finished goods are manufactured in other countries.

Is this always bad?

Well, that’s a moral question more than an economic one.

Every time someone pays more for something, someone else receives more.

It can not be any other way.

Now personally, I’m fine with fast food costing more if fast-food workers then earn more.

So while there is a “moral component” to a discussion of inflation, that’s beyond the scope of this post.