If this concept is new to you, the first question is what is a federal reserve repo?

Federal reserve repo means Fed “repurchase agreement”

A Federal Reserve repo is a repurchase agreement which is a short-term loan whose collateral is some form of a security (bond) generally a US treasury security.

An institution (bank, hedge fund, etc) that has some securities and needs cash, borrows the money from the Fed uses some securities as collateral.

While the term can be as long as 65 days, generally they are paid back the next day.

Because the loan term is so short, there is only one payment to make, and that payment includes the principal plus the interest, which is known as the repo rate.

There is also such a thing as a reverse repo, which is when the institution loans money to the Fed, and the Fed provides some securities as collateral.

Why do repos exist?

While there are a bunch of things repos are used for, per the New York Fed:

The Fed uses these two types of transactions to offset temporary swings in bank reserves; a repo temporarily adds reserve balances to the banking system, while reverse repos temporarily drains balances from the system.

It’s about keeping the commercial banking system working.

What are banking reserves? Why do they matter?

There is a limit to how much a bank can lend, based on the reserves they have on deposit at the Federal Reserve.

Let’s say the mandated reserve requirement is 10%, which it historically has been.

When a bank has $1M in reserves, it can then loan out $10M.

With $100M in reserves, it can loan out $1B.

When a bank has made loans to the limit of what their reserves allow them to do, they’re “loaned out” and can make no more loans.

So banks are limited by reserves?

You might think so, but no.

The reason banks are not limited, the reason banks will loan out money without so much as even checking their reserve balance, is because when they need more reserves, the needed reserves are made available.

The needed reserves come from one of two places:

Banks with excess reserves loan them out

It sometimes happens that a bank may have excess reserves, the excess being that they could loan out more money if people showed up and wanted to borrow some.

But the amount people want is less than their limit.

Their excess reserves sit in reserve accounts that pay no interest.

While the interest on a reverse repo is small, it’s greater than zero, so when a bank has excess reserves, there is no reason not to lend them to the Fed.

The reserves that some banks loan to the Fed are available for other banks to borrow.

If the banking SYSTEM needs reserves, the Fed creates them

When the banking system is loaned out, and reserves need to be added so that banks within the system can continue to make loans, the Fed adds money to the reserve balances of their member banks, but that money doesn’t “come from” anywhere.

It is not transferred from any other account.

It simply appears in the reserve accounts of the member banks when someone at the Fed uses a computer to change some numbers in a banking system database.

How does the Fed have authority to create new banking reserves?

It’s part of the Federal Reserve Act, the law which created the Fed in 1913.

One of the principal objectives of the Fed is to maintain a stable interest rate.

The interest rate is “the cost of money” and like everything else, the cost, or price, of money is a function of supply and demand.

If the banking system is “loaned out” while there is still demand for loans, demand will exceed supply, people will be willing to pay more for loans, some people who have loans might be willing to sell them for a profit, and the cost of money will rise.

Just like any other thing being sold in any other market.

But, the Fed has a responsibility to manage to a target interest rate, so they can’t let that happen.

So, to prevent demand from exceeding supply, they inject reserves into the system to increase the supply.

But aren’t reserve requirements now 0%

Yes.

On March 26, 2020, as part of the US national response to the Covid19 pandemic, the US banking reserve requirement was set to 0%, which means effectively there is no US banking reserve requirement and there is no limit on the ability of US banks to make loans.

And as a result, repo activity did drop to zero, although not right away.

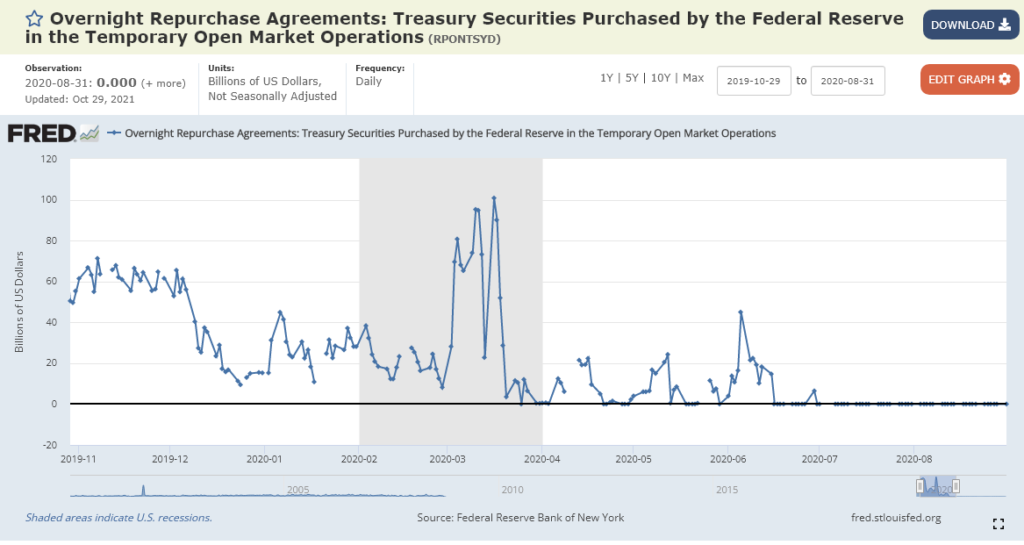

As you can see in the chart below, there was some repo activity from Mar of 2020 to Jul of 2020 before the activity level dropped to zero.

Does that mean ALL reserves became excess reserves?

Yes, it does.

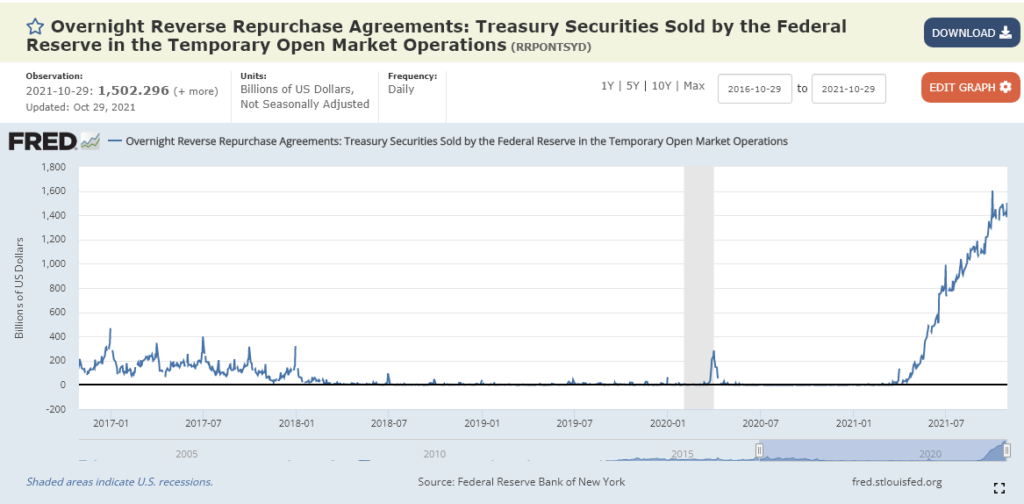

And as you can see in the chart below, the Fed has been sucking reserves out of the US banking system ever since, although interestingly, this didn’t really start doing so until about Mar of 2021.

For the record, not every country HAS reserve requirements

Canada abolished theirs in 1992.

The UK, New Zealand, Australia, Sweden, and Hong Kong also have no banking reserve requirements.

2 Responses

Excellent post, this helped greatly.

I’m glad it helped. I think this topic is often discussed in ways that are excessively complex when at its core, it’s prettysimple.