Table of Contents

No, the currency issuer can not spend endlessly

I’ll use the USA again in the examples below.

The US federal government (the currency issuer of US dollars) is constrained in it’s ability to spend.

They are constrained by the productive capacity of the economy.

What is “the productive capacity of the economy”?

It’s the total of all goods and services produced.

Below is a simplistic view of this idea, but you’ll get the idea.

When an economy is below full employment, the economy can, and does, expand when more money is added. More people can buy more stuff, and the people who make stuff make more in response to increased demand.

When an economy is at full employment, adding more money to the economy does not result in people making more stuff, as the economy is already at full employment.

When you add more money to an economy that is at full employment, you create demand the economy will not fulfil, as the economy is already at full employment, so prices go up.

How do we know when an economy has too much money?

Two things happen:

- Unemployment drops to zero.

- Prices rise. We experience what we call inflation.

How do we know when an economy has too little money?

Throughout US history, every time we decrease the amount of money in circulation by “paying down” some of our “national debt”, we set the stage for recessions and depressions.

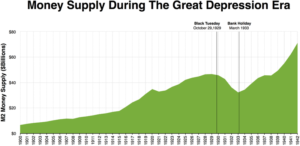

The image at the top of this is an image showing the US money supply from 1900 to 1942.

You can see how an increase in the money supply contributed to “the roaring 20’s” while a reduction in the amount of money contributed to the great depression.

This is not an isolated incident. The federal budget surpluses of the Clinton administration set us up for the great financial crisis some years later.

Why isn’t this more widely known?

My comments below are more guesswork than knowledge.

The answer seems to be that what is called “classical” or “neo liberal” economics is based on faulty assumptions.

I know that’s a bold statement, but since the failure of economic models to accurately predict things like the Global Financial Crisis of 2008, and the constant fears since then that “printing more money” will cause inflation that never materialized, there is a strong argument that the models built upon the assumptions of classical or neo liberal economics do not describe the real world.