Post Keynesian economics is called post Keynesian because the name “Keynesian” was taken,.

Ironically, by economists who do not follow the teachings of John Maynard Keynes, whom the school of thought is named after.

This occurred due to a fundamental misunderstanding of something Keynes wrote in his General Theory (more on this later).

This post is a summary of chapter 6 (Post Keynesian Economics) of the book Contending Perspective in Economics by John T Harvey Ph.D. I’m summarizing this book because it’s such a great little book (151 pages, but packed full of insights).

Table of Contents

Origins of post Keynesian economics

Who was Keynes and how did “Keynesian economics” come to represent something he did not think was true?

John Maynard Keynes was a classically trained economist who learned the teachings and traditions of what is now called neoclassical economics.

He saw some things that didn’t fit his observations of the world. Specifically, neoclassical economists teach that:

- An economy always reaches an equalibrium at full employment.

- There are no obsticles to this occurring.

Bear in mind, the neoclassical economists did not believe it would necessarily happen right away, but it would happen as it could not otherwise.

Early career

Keynes had various jobs with the British government from 1906 to 1946, with a lapse from 1909 to 1914 when he was a fellow at Kings College.

He returned to the government in 1914 when the British government re-recruited him as they entered WW1.

At the Versailles peace conference Keynes’s main interest was in preventing Germany’s war reparations from being so high it would hamper the ability to rebuild the German economy.

He feared heavy reparations would interfere in rebuilding the productivity capacity of their economy, leading to pervasive shortages, and hyperinflation.

During the 1920’s he continued to advocate for a reduction of German reparations.

The Great Depression

When the Great Depression started in 1929, he could not shake the idea that one of the core principles of neoclassical economics, the idea that an economy always reaches equilibrium at full employment, was simply not true.

Per the idea, in periods of unemployment, workers will be willing to work for lower wages until firms who can afford to pay those lower wages would eventually hire everyone as the economy returned to full employment.

But this wasn’t happening.

So he basically rethought everything and in 1936 published the book for which he is most famous: The General Theory of Employment, Interest, and Money.

In it, he argued that the Great Depression demonstrated definitively that economies do not seek equilibrium at full employment.

That just did not happen.

While economists were discussing the ideas, Germany invaded Poland in 1939, and Keynes, and pretty much all his contemporaries, were told to drop what they were doing as they needed to help figure out how to pay for the war.

Keynes was working on this until 1945 when the war ended.

He died in 1946.

The “split” between Keynesians and Post Keynesians occurred due to a misunderstanding of what he was trying to say about “equilibrium at full employment”.

One group thought he said, “Equilibrium at full employment happens, but there are obstacles”. These people called themselves Keynesians.

Another group thought (correctly) that he said “Equilibrium at full employment does not happen”. These people called themselves post Keynesians.

So weirdly, the Kenysians are not following what he wrote and the post Keynesians are.

Uncertainty, animal spirits, and demand

These three concepts form the cornerstone of his ideas.

Demand

Perhaps THE core idea of Keynes’s economic views is that economic growth is driven by demand, not investment.

In order for firms to sell enough stuff, there have to be people who both want to buy that stuff, and can afford it.

The neoclassical view is that investment drives growth.

Keynes argued that a flaw in the neoclassical view is firms hire when they’re building out capacity (building factories, warehouses, restaurants, etc).

Then when they’re ready to “go live” and start making money, the building phase stops, and the people who did the building become unemployed.

Being unemployed, they then lack sufficient income to buy the stuff the firms are selling.

Another significant difference between Keyes and neoclassical economics is the idea of why people save.

In the neoclassical model, people want to consume now but can be persuaded to save by banks offering higher interest rates.

Keynes said no.

He saw people saving even at very low-interest rates.

He perceived that what they were doing was BUYING future stuff.

They were saving up for a rainy day, to buy stuff later when they had less money coming in.

This is not something the neoclassical model acknowledges.

Uncertainty

To Keynes, uncertainty is not the same as risk.

Risk is when there is a deck of 52 cards, 13 of each suit, and you bet and get paid on successfully guessing the color of the next card.

For any one card, the odds are 50/50, but as the cards left on the deck get smaller you may notice more black or more red have been drawn, and that changes the odds for future draws.

Uncertainty is when you have no idea how many cards are in the deck or how many of which suits there are.

The entire deck could be black, or red, and you don’t have enough information to detect a pattern no matter what.

Keynes argued that there are so many economic variables affecting what would happen that detecting patterns and signals was not something the average person, in econospeak, an “agent” operating in the economy, would be hard-pressed to make big bets based on rational decision making.

Keynes further argued that saving for a rainy day is one of the things that dampens current demand.

Animal spirits

To me, the name “animal spirits” is yet another example of economists being terrible at marketing.

What the heck are animal spirits?

Animal spirits are what lead us to believe we can succeed where so many others have failed before.

It’s why some weird humans were determined to sail across the ocean, climb Mt. Everest, run a 4-minute mile, fly faster than sound, go to the moon, succeed in business, etc.

Without animal spirits, there would have been no steam engine, no industrial revolution, no Kitty Hawk, no electricity, no computers, you name it.

Without animal spirits, we would still be living in hunter-gatherer societies.

And while it’s hard to quantify, it explains why we keep trying stuff other people have failed at repeatedly.

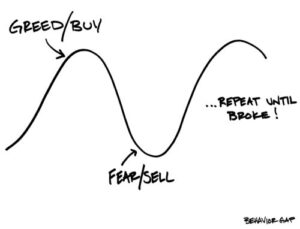

The business cycle

Post Keynesians believe the business cycle is not a result of external forces, but rather everything within the business cycle creates the business cycle and influence/determines when growth cycles and recessions start and stop.

While all spending represents demand, investment spending far exceeds consumer spending in any economy.

For that reason, growth in investment spending starts booms, and reductions in investment spending start busts.

The boom

Due to some irrational optimism about the future (animal spirits), people think the economic future will be better.

So they start or expand businesses.

They spend on building new factories, updating or expanding existing ones, building new retail outlets, remodeling or expanding existing ones, etc.

This spending spurs economic activity and growth.

As more people see economic expansion, it fires up their animal spirits and they don’t want to miss out on the coming prosperity, so they participate in some way.

This investment spending ripples through the economy resulting in a boom cycle.

The bust

After some number of years of increasing investment spending, some people start to get nervous about how much debt they’ve taken on, that sales were slightly down three months in a row, and be concerned that maybe their prior optimism was maybe a bit too strong.

So they start to look for where they can reduce spending.

When they reduce spending, the people who previously received that spending have less money, so they too look to reduce spending.

This reduction in spending also ripples through the economy.

And repeat

This bust cycle lasts until a lot, perhaps most, people have forgotten forget the concerns they had which caused the slowdown, and their animal spirit optimism causes them to see prosperity in the future, and the cycle starts over.

Money and financial markets

People who want to build or expand factories, or restaurants, or retail outlets, tend not to have enough money lying around in cash.

So they borrow.

Larger firms sell stock.

Because banks create new money when they make loans (seriously, when you borrow money from a bank it doesn’t “come from” anywhere), borrowing money has economic impacts.

So, when a bunch of firms borrows money at or near the same time, the amount of money in circulation expands as a result, thereby increasing demand more than if this were not true.

To further complicate things, what we do with the money after we’ve borrowed it matters.

What borrowed money is spent on matters

Roughly speaking, when we borrow money we either spend it in ways that increase the production of goods and services (build/expand factories, warehouses, restaurants, retail outlets, etc) or we use it to buy assets (stocks bonds, real estate, etc) we hope will appreciate in value.

Increasing the production of goods and services

This type of spending grows the economy. It increases the material wealth of society by increasing the amounts of goods and services produced, which is the REAL wealth of a society.

Buying assets

This type of spending does not grow the economy, and quite the opposite, borrowing to buy assets fuels asset bubbles.

Why? Because when people borrow money to buy assets, they bid up the price of the asset leading to a general increase of the prices of that type of asset.

However, the same “animal spirit” feelings of irrational exuberance and later fears of being overextended (these assets are being bought with borrowed money) occur here, and when asset bubbles burst, economies go into decline.

In the case of the Great Depression and the Great Financial Crisis, they pushed the economies of the world into a significant decline that took years to recover from.

Methods

This quote from Keynes describes the method he thinks matters:

The object of our analysis is, not to provide a machine, or method of blind manipulation, which will furnish an infallable answer, but to provide ourselves with an organized and orderly method of thinking out paticular problems; and, after we have reached a provisional conclusion by isolating the complicating factors one by one, we then have to go back on ourselves and allow, as well as we can, for the probably interations of the factors amongst themselves. This is the nature of economic thinking. Any other way of applying our formal principles of thought (without which, however, we shall be lost in the wood) will lead us into error. It is a great fault of pseudo-mathematical methods of formulating a system of economic analysis, such as we set down in section vi of this chapter, that they expressly assume strict independence between the factors involved and lose all their cogency and authority if this hypothesis is disallowed; whereas, in ordinary discourse, where we are not blindly manipulating but know all the time what we are doing and what the words mean, we can keep “at the back of our heads” the necessary reserves and qualifications and the adjustments which we shall have to make later on, in a way in which we cannot keep complicated partial differentials “at the back” of several pages of algebra which assume that they all vanish.

Keynes, 1936, pp 297-8

Perhaps a summary of his methods are:

An economy is too complex to reduce to a system of equations.

Behaviors are rarely independent of one another.

Economies are open systems.

Post Keynesians trust their analysis, including mathematically, precisely because they recognize their limitations and view with mistrust schools of economic thought that “prove” relations or uncover fundamental truths.

Post Keynesians place a great deal of importance on understanding causal linkages between things in a real economy.

It’s not enough to state that X happens. It’s important to understand the causal relationships between things in the real economy to explain HOW X happens.

Post Keynesians believe that if an argument is built with premises that do not match what we see in the real world, that argument can be discarded.

Views of human nature and justice

Post Keynesian economists believe humans are social animals.

They view the structure of institutions (banking for example) hold the keys to how economies work.

They believe every member of society should share in our collective economic output.

They believe that modern economies are so productive that it is immoral to leave people behind, that people are not lazy, and that people want to work, provided the work is not dehumanizing.

They believe that when the private sector, as sometimes happens, can not provide full employment, that the government must step in and deficit spend the economy to full employment, but that the way governments do it today is suboptimal.

Criticisms

Post Keynesians are accused of being more interested in attacking neoclassical ideas than developing their own.

And some more left learning schools of economic thought see them as apologists for capitalism as post Keynesians push the idea that we should fix capitalism, not scrap it.